Home » Credit Cards » American Express (Page 2)

Category Archives: American Express

Hilton: double night credit offer, 30% Amex UK conversion bonus

In addition to its double points global offer, Hilton has launched another double night credit promotion which makes it easier to attain elite status and potentially earn even more bonus points.

- Stay between October 11 and December 31

- Earn double elite night credit for all stays

- It counts towards Milestone Bonuses and Rollover Nights too

As usual, both paid and award nights can trigger the bonus. Existing bookings prior to registration count too, so there’s no need to cancel and rebook.

Your check-in / check-out date doesn’t matter, but only nights falling into the promotion period earn bonuses. For example, if you check in on October 9 and check out on October 12, only the last night is eligible.

It’s a nice gesture to make them count towards Milestone Bonuses, which means if you are approaching or above 40 nights, you earn 10,000 bonus points for every 5 nights stayed, on top of all the other promotions.

Last but not least, although not 100% official, multiple people received confirmation from CS that the bonus counts towards Diamond Challenge too – which means you only need six nights for the Diamond status.

Meanwhile Amex UK started a conversion bonus recently which has totally gone under the radar. You get a 30% bonus when converting Membership Reward points to Hilton by November 3, which means 1 MR point = 2.6 Hilton points.

In my opinion it’s still not a great ratio, but if you need some Hilton points right now or you’ve been saving up for a Maldives trip, it could work out in your favour.

My review of American Express Centurion Lounge, Seattle

I wrote about the Amex Centurion Lounge at Denver which wasn’t very impressive. There’s one in Seattle as well, and I’m gonna give it another try after having spent some time in the nice Sky Club.

It’s just one minute away from the Sky Club, with a very recognisable entrance.

Bad news upon entry: the lounge is already full. But fortunately I don’t have to wait long as I’m on my own.

It is indeed very crowded:

But I’m assigned a pretty comfortable seat.

There’s also some reserved seating which are presumably for Centurion members.

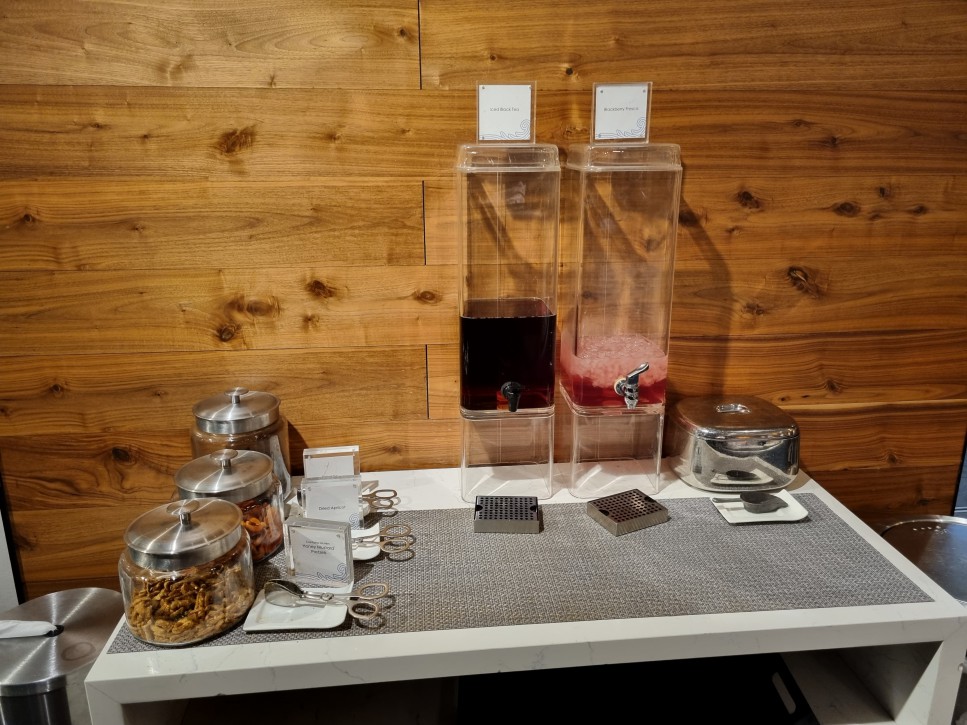

A couple of more photos of the decoration.

More seats are available in the bar area, but still limited.

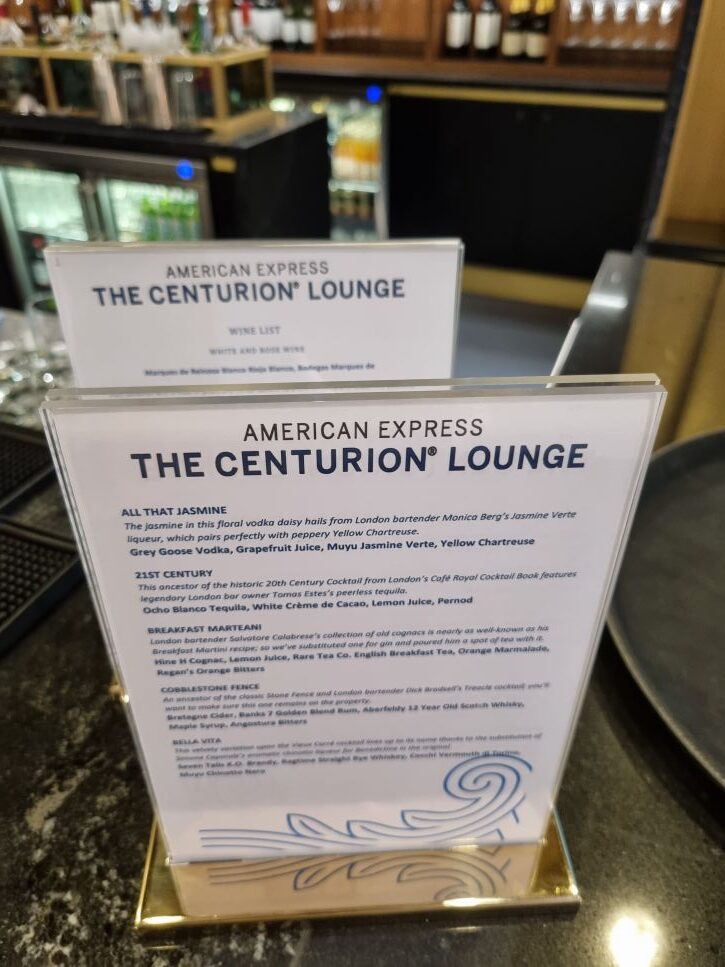

All alcohol drinks, including cocktails are free.

The buffet menu for hot food:

- Spicy collard greens

- Carolina beef grifts

- Grilles asparagus

Again I’m a bit disappointed at the quality of this lounge, and neither of the two Amex Centurion lounges that I’ve visited in the States are anywhere near the standard of the London one.

Apply for a US Amex card via Global Transfer

[Background]

The credit card market in the United States is way more competitive than anywhere else in the world, and as a result the payment cards offer substantially higher bonuses and better benefits than, say, the UK. Take American Express as an example, it’s not uncommon to see the same card hands out 3x the sign-on bonus plus better day-to-day perks.

Interested in getting a card in the US? It’s actually much easier than you think. First of all you don’t have to be a Resident Alien (I still find the term very amusing) to be eligible, although you do usually need to have a tax identification number, i.e. SSN or ITIN. They are similar to the National Insurance number in the UK, and you need to provide them when submitting a credit application.

There are workarounds though, especially with American Express. We wrote about its Credit Passport feature a while back which approves your US credit card application using your UK credit history. In fact there’s an even easier route, as long as you are already an Amex customer in another country.

The feature is called Global Transfer, and you can read more about it on Amex’s website. You only need to meet the following criteria to apply:

- Be an existing Amex customer

- Have an address in the destination country to receive the card

- Have a telephone number in the destination country

You don’t need a credit history in the destination country, and in the context of United States, nor do you need SSN or ITIN. It works in a similar fashion with Credit Passport, but utilises your client record with Amex instead, which I imagine is in your favour.

In theory you can global transfer from any country to any other country, as long as Amex does business in both of them. There are few exceptions (such as China) due to local financial regulations.

[Why Global Transfer]

As I’ve just mentioned, Amex cards in the US are much better than the UK counterparts from almost every perspective. It’s critical to choose the right card to start with, as you can only request one via Global Transfer and you’ll be stuck with it for a while. (Anecdotes suggest that you may apply for two card simultaneously if applying by phone).

I started with the Platinum card mainly because they were offering a huge sign-on bonus. Compared to the UK version, the US one has the following advantages:

- Better earning rate (1 point / $1)

- Frequent conversion bonus to airline / hotel programs

- No foreign transaction fee

- Priority pass with +2 guests

- Annual credit for FHR and US airlines

You can also transfer UK membership rewards points to the US one at the current exchange rate.

I don’t see myself holding the US Platinum card in the long term, but as I said it’s just a start point.

[Making an application]

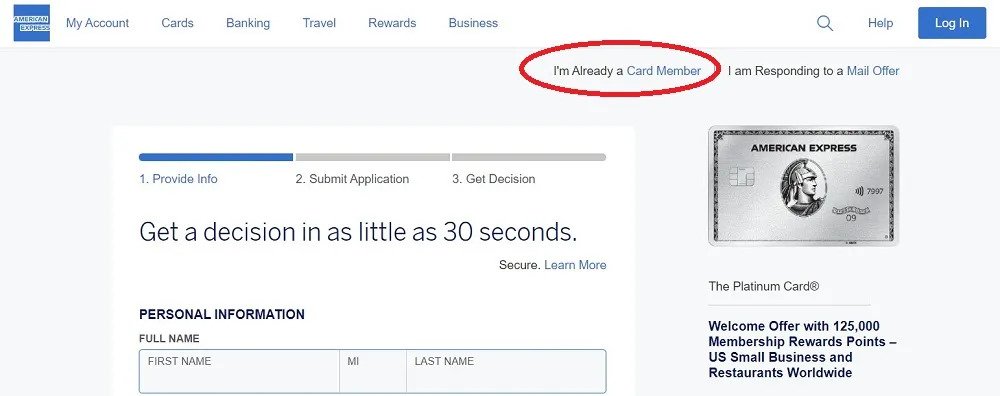

We all love earning referral bonuses, but you can’t do global transfer and refer a friend at the same time. You should start your application on Amex’s website, and some public partner offers work too (for example this one from Resy).

The procedure is quite simple. When applying, click I’m Already a Card Member at the top right:

Sign in using your Amex UK credentials and the form would come back partially pre-filled.

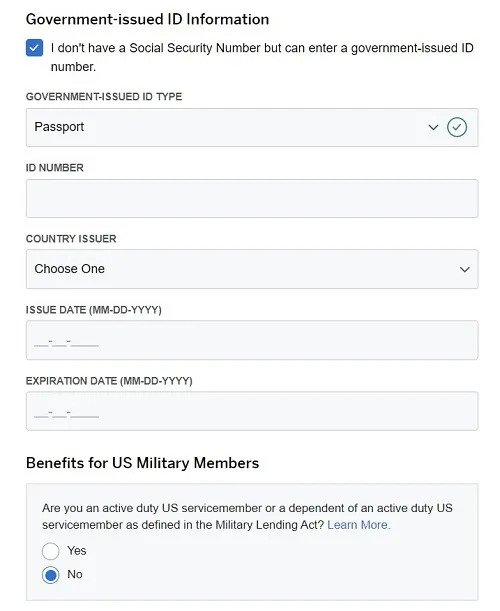

Tick the box declaring that you have no SSN, and fill out the remaining information including your passport number, US address and phone number.

Assuming that you’ve been a great client of Amex, your application should be approved right away.

[Receiving the card]

If you are not physically present at the shipping address, whoever receives the card should forward you the necessary information to activate it.

Since Amex supports Google Pay / Apple Pay, adding the card to your e-wallet should satisfy 99% of your use cases. In the unlikely event that you require a physical card right away, the safest route is probably ask your family/friend to send it across to you.

However, if you have the Platinum card, it’s also legit and straightforward to request a replacement card of an alternative design.

Go to online chat and ask the agent to add an alternate address to your profile, and you can enter your international (UK) address. You could choose a design and request it to be sent to your alternate address in the same conversation. My card arrived in five days.

Since it’s not a lost/stolen situation, the old card remains functional. I’m not sure how long you must wait after card opening to request the replacement though.

[Payment]

Since most (all?) US Amex cards charge no foreign transaction fee, you can use them safely in the UK and abroad. The next question you may have is probably how to make payment, which is surprisingly easy.

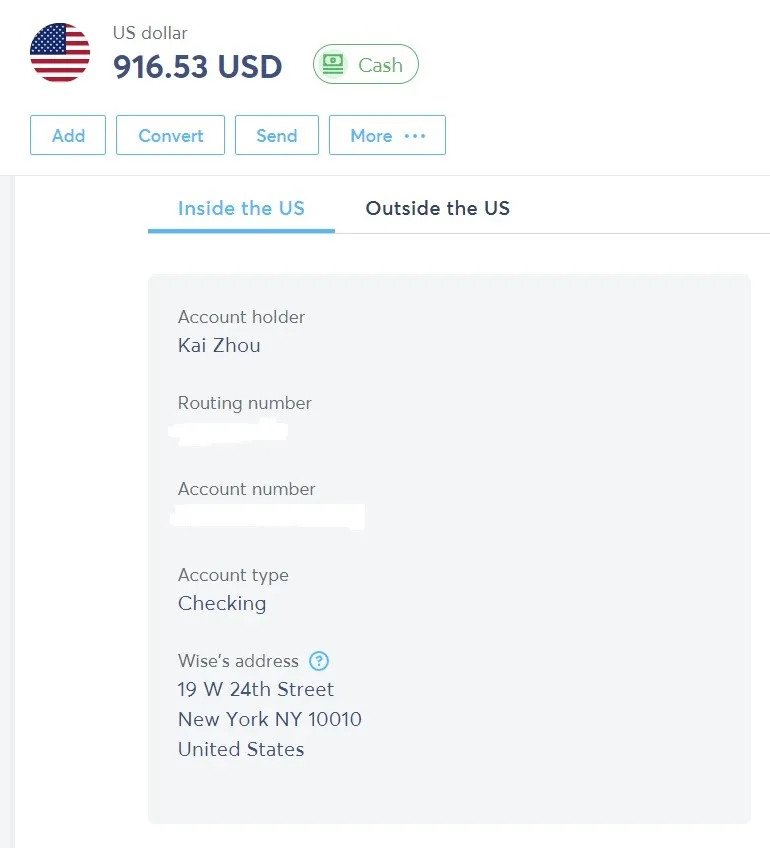

All you need is a Wise (formerly Transferwise) account. Once registered you can open a USD Personal Checking Account. They might need to verify your identity (e.g. UK driving license) which shouldn’t be a problem.

With the routing number and account number, you can link your Wise account in Amex online banking. It doesn’t work like Direct Debit in the UK though – every month after your billing date you still need to log in to Amex online banking and click a button to pull funds from Wise.

You can transfer your GBP funds in a UK bank to Wise’s USD account very easily. The exchange rate is favourable, and the handling fee is only about 0.3%.

If you are new to Wise, feel free to support us by using my referral link which gives you a fee-free transfer of up to €500.

[Conclusion]

I believe that’s all the essential information you need to know now. Once you’ve built up enough history with Amex, you can start applying for more cards, but that story is for another day.

My review of Amex Centurion Lounge, Denver

I’ve had the Amex Platinum card since 2014, but it’s not until now have I visited an Amex Centurion lounge in the States. I was actually in Miami the other day which also has a Centurion lounge, however at the wrong terminal and airside inter-terminal transfer was not possible so I missed the opportunity there.

It’s not an issue in Denver thankfully, so although my Delta flight departs from a different Concourse I’m still able to access the Centurion lounge in Concourse C. I just need to take the shuttle train from Concourse A to C and then back after my visit.

The Centurion lounge is near Gate 46, take the escalator up once you see the sign.

Platinum cardholders can guest up to two people, so I’m able to bring my friend with me. Note that starting from 2023 US-issued Platinum cards can no longer bring any guests unless they spend at least $75,000 the previous year, whilst cards issued by other countries remain unaffected.

The spending target is pretty high, and the aim is to address the overcrowding problem which is getting worse by the day. Denver is no exception:

The lounge is not huge but has a decent size, so despite being fairly crowded it’s not too difficult to find a seat.

Some areas have a view of the runway of airport interior.

There are a pool table and shuffleboard for fun.

The same decorative wall as I saw in London.

It’s early in the morning, so breakfast service is available. Some of the dishes include eggs, sausages and fried potatoes.

All drinks including cocktails are free at the Centurion lounge, which is an edge over other airline lounges in the United States that makes it different.

You can also make yourself a coffee or orange juice, however it’s pretty hard to spot a free glass anywhere.

In conclusion – I think the lounge itself is more than fine, as the decor is nice and the food offering is okay. The experience is considerably overshadowed by the capacity issue though, which is likely to improve from February next year.

What are the benefits of UK American Express Centurion card?

A friend of mine has just received his UK Amex Centurion card. Usually nicknamed the Black Card by the public, it is probably the most prestigious bank card out there, and very few people are eligible to even receive an invitation to apply. Still, many people – just like me – are very curious about its eligibility criteria and benefits, and I’ll take this chance to briefly talk about them.

[Background]

First of all, my friend already has the US Amex Centurion card. Having been a customer with both Amex US and Amex UK, he was quite frustrated with the difficulty to obtain a Centurion card in the UK, and shifted all his spend to the US Amex cards from late 2020.

He spent roughly two million dollars over a span of eight months, and then successfully received an invitation to apply for the Centurion card after querying the Platinum Concierge services.

Interestingly, he is based in the UK and none of the two million dollar purchases was made in the US.

[Get the UK card]

If you already hold the US Centurion card, you can acquire one in other countries through Amex Global Transfer services. It’s a privilege of the US card though, as Centurion members in other countries can’t acquire a US card through the same procedure.

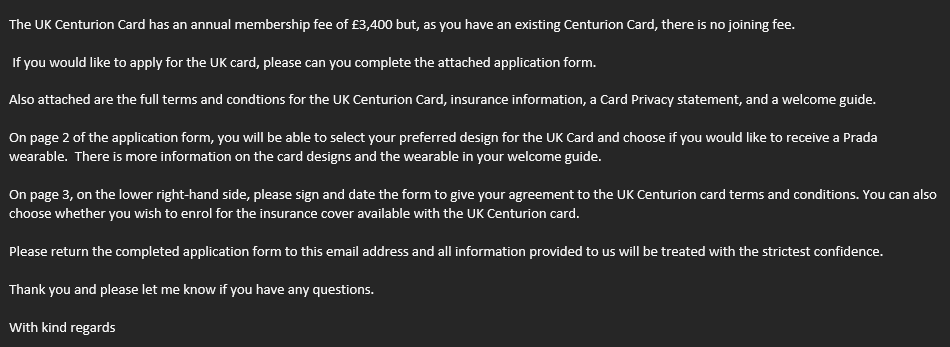

Since my friend is based in the UK, it’s sensible to apply for a UK Centurion card too. After receiving the invitation, he still needs to fill out a form.

[Fees]

Because he’s already a Centurion cardholder, the joining fee is waived. Last I heard the fee was £3,000, although I’m not sure if it has increased since.

The annual fee is £3,400.

Unlike the US counterpart, the UK Centurion card comes with a free supplementary card.

[Welcome Box]

It took five days for the application to go through, and then two more days for the cards to arrive.

[Card Designs]

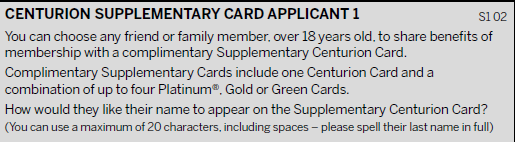

Similar to the US Platinum card, the Centurion card offers two artist designs besides the classic design, by Kehinde Wiley and Julie Mehretu respectively.

The two UK cards and one US card completes the collection 🙂

[Status Benefits]

The Centurion card offers elite status with the following airlines:

- Virgin Atlantic Flying Club – Gold

- Emirates Skywards – Gold

The following hotels:

- Hilton Honors – Diamond

- Marriott Bonvoy – Gold

- IHG One Rewards – Platinum

- Melia Rewards – Platinum

- Radisson Rewards – Gold

- Jumeirah One – Gold

And two car rental companies:

- Hertz – President’s Circle

- Avis – President’s Club

It may strike you first as an extensive array, but once you dig into the details you will feel much less excited. Hilton Diamond has substantial benefits but it’s not difficult to get; Melia Platinum and Jumeirah Gold have good perks, but their footprint is limited. Marriott Gold and IHG Platinum are next to useless…

In terms of airlines, the two offers are good, however neither VS or EK belong to any major alliance so the memberships don’t get you very far. In contrast, US Centurion card offers Delta Diamond status which is accepted across the entire Skyteam, and my friend also availed Star Alliance Gold and Oneworld Sapphire via status match programs.

[Lounge Benefits]

Lounge access benefits are almost identical to the Platinum card:

- Priority Pass (+1 guest only)

- Amex Centurion Lounge

- Eurostar Lounge

- Plaza Premium / Lufthansa / Delta / Escape Lounges etc.

The Centurion card only makes a difference when you access the Centurion Lounge or the Lufthansa Lounge. You can read more about the Amex Lounge benefits here.

The US Centurion Card issued Priority Pass can bring in unlimited number of guests.

[Other Benefits]

Fine Hotels & Resorts: stay a minimum two nights and enjoy an additional $200 credit on FHR bookings at select luxury hotels.

Limousine Transfers: eight complimentary two-way airport transfers, but the snag is you must book the flight with Centurion services.

Airport Fast Track: available at Heathrow, Stansted, Manchester and East Midlands.

Lifestyle Credits:

- Harvey Nichols: £500 annually

- Clos19: £500 annually

- Addison Lee: £20 monthly

[Travel Insurance]

From what I’ve heard it’s way better than the US card.

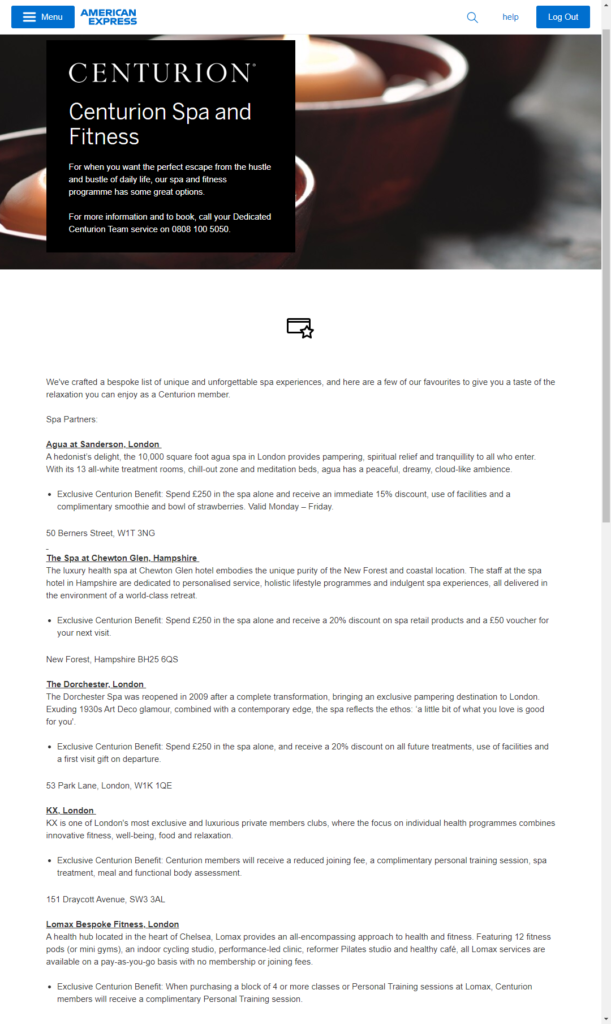

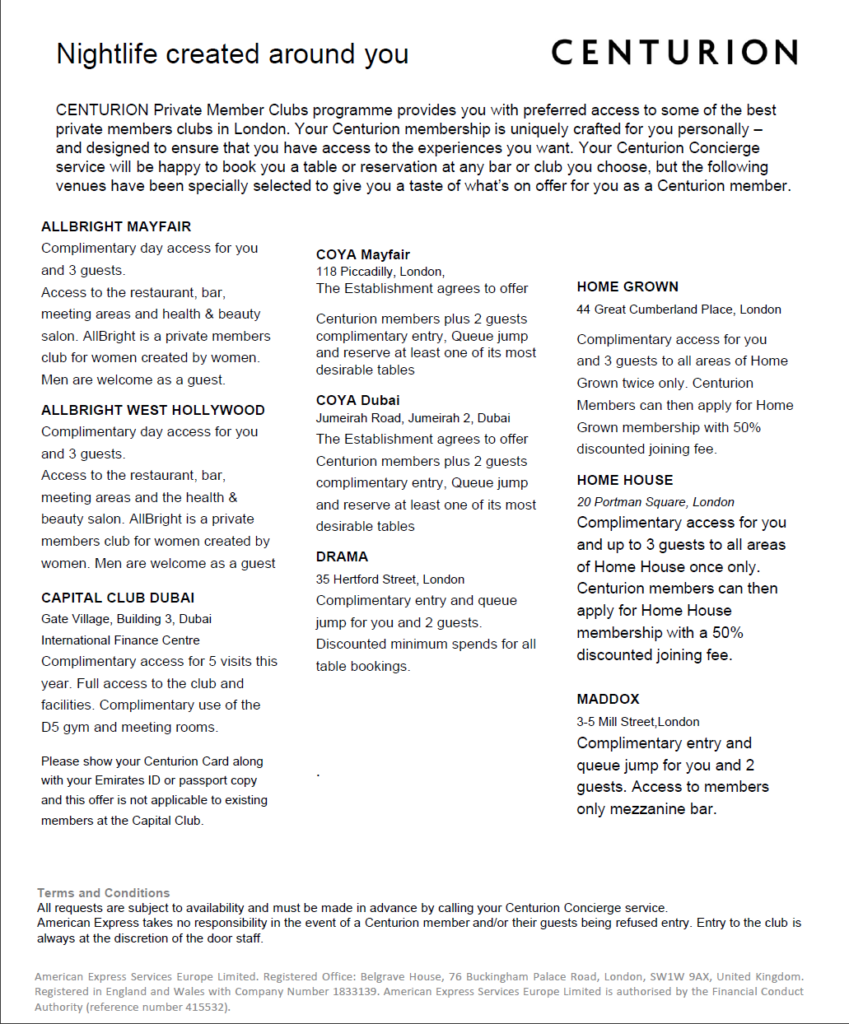

[Spa, Fitness and Clubs]

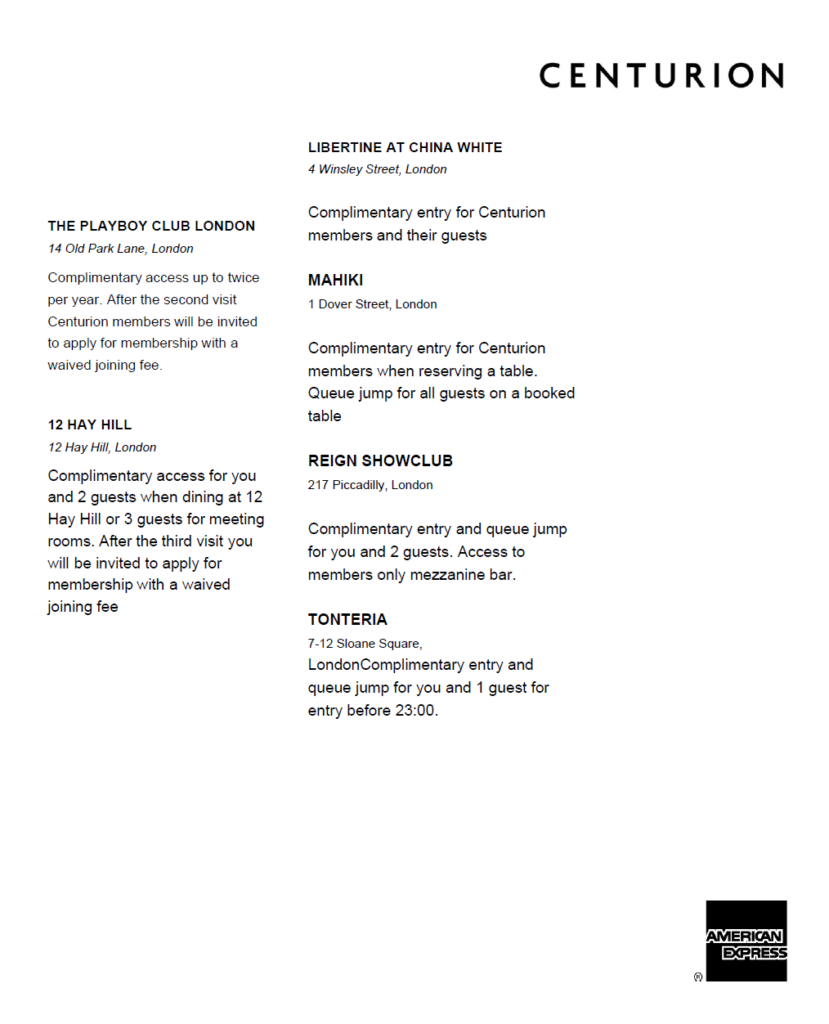

[Refer A Friend]

Something that you surely didn’t know – The Centurion card also has an invite-a-friend feature:

However, the referral link opens an application for the Platinum card…

Okay that’s it! I’ll probably never qualify for this card, but to be honest the benefits are underwhelming and I wouldn’t pay £3,400 anyway. What do you think?

Apply for a U.S. card without SSN/ITIN via Amex Credit Passport

U.S. no doubt has the best credit card offers in the world, and many people from overseas are very keen on applying for one. It’s tricky though, as unlike in the UK you usually need to provide a tax number (SSN or ITIN) when submitting an application, and you may not have one if you still live abroad or have recently moved.

There’s a well-known workaround though – if you are an Amex cardholder overseas, you could apply for a U.S. Amex card via its Global Transfer service. You don’t need an SSN / ITIN or any credit history in the U.S. – all you need is a U.S. residential address and a phone number, and Amex will use your internal credit record with them to evaluate the application.

It’s usually a very smooth process, and everyone I know who’ve tried succeeded, although some of them were asked for some sort of bank verification.

It’s not until recently that I became aware of another service that Amex U.S. offers – Credit Passport, provided by Nova Credit.

The idea is quite similar to Global Transfer, which aims to facilitate the application for people who don’t have a tax number yet in the country. However,

- You don’t need to be an existing Amex customer

- Your credit history in the current residential country will be used for the application

Currently nine countries are supported: United Kingdom, Canada, Australia, Mexico, Brazil, India, Kenya, Nigeria and Dominican Republic.

Note that the application only triggers a soft pull in the United Kingdom as well as in Canada, Australia, India and Dominican Republic, which means it doesn’t negatively impact your credit score.

To be honest I don’t think it’s a very useful feature, as all listed countries issue their own Amex cards, with the exception of Dominican Republic. My speculation is that having an Amex card and doing the Global Transfer would have a much higher success rate.

However, if somehow you don’t have an Amex card, or the Global Transfer doesn’t work out, you may want to try Credit Passport to apply for your first U.S. credit card. A reader from Canada has just reported success so it’s a viable route.

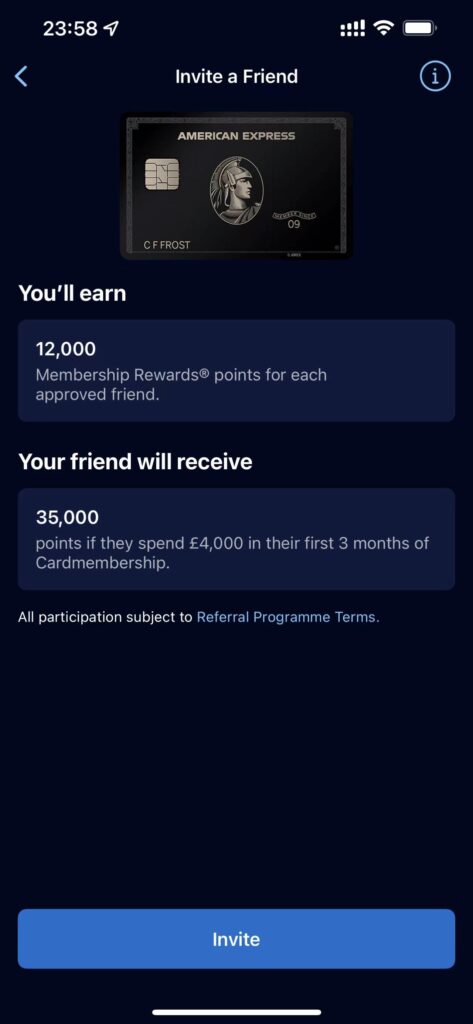

My review of American Express Centurion Lounge, London Heathrow Terminal 3

Without any specific planning, I came to realise that my BA flight departs from Heathrow Terminal 3 in the booking process. In terms of (Oneworld) lounge situation Terminal 3 is much more preferable than Terminal 5, given the lounge choice between British Airways, American Airlines, Cathay Pacific and Qantas. And even better, American Express just opened its new Centurion Lounge in October 2021, so it’s a great opportunity for me to check it out.

Amex has now opened a handful of Centurion lounges globally outside the United States. I’ve visited the one in Hong Kong a couple of times pre-pandemic and really liked it.

I have the whole day to myself at Heathrow so spend some time in the much loved Qantas and Cathay lounges too, which I’ll write about later. T3 feels much smaller than T5 or even T2, but the signage is a bit confusing and it takes me a while to find the Amex Lounge.

It’s nicknamed Lounge A – turn right after security, and you’ll find a lift towards the end.

One level up and the lounge entrance is right in front of you. There’s a kid’s club on the left but I didn’t check it out.

Entry rules are as follows:

- Amex Platinum card members can bring up to 2 guests

- Amex Centurion card members can bring up to 2 guests, or the entire immediate family (spouse and underaged children)

- You are allowed entry from three hours prior to your flight departure

The guest rule is generous enough, however unlike airline lounges, you can’t show up anytime on the day even if it’s way ahead of your departure. Amex card, passport and boarding pass are needed for verification.

The interior is mainly wooden or beige.

There’s a business room immediate to your left. Small cabins are provided which are very convenient if you need to attend a phone call or video conference.

Move forward to see the bar and dining area.

With a very delicate afternoon tea set at the side.

And a semi-private relaxation area.

That’s about it. Size-wise the lounge is nowhere near how the Qantas one measures, not to mention the huge space Cathay occupies. However it’s really new and tastefully furnished. You may have noticed the London map in the picture above already, and there’s also a display of cricket bats:

What I love most is this turquoise retro display made of books and suitcases:

Food is arranged in small plates and feel free to take all you can eat.

There are chicken, beef and vegetarian options. Presentation is really nice and so is the taste. The Japanese soba noodles are quite good.

Don’t forget to grab a drink from the bar too – they have cocktail menus.

Usually I’d say Cathay Pacific Business Lounge is my favourite at Heathrow, given its various dining and super comfortable seating options. Comparatively, the Centurion Lounge is much smaller, but feels more upscale and is slightly better in terms of food. The next time you are at T3, don’t forget to reserve some time here.

NEW: You can now prepay Amex FHR bookings

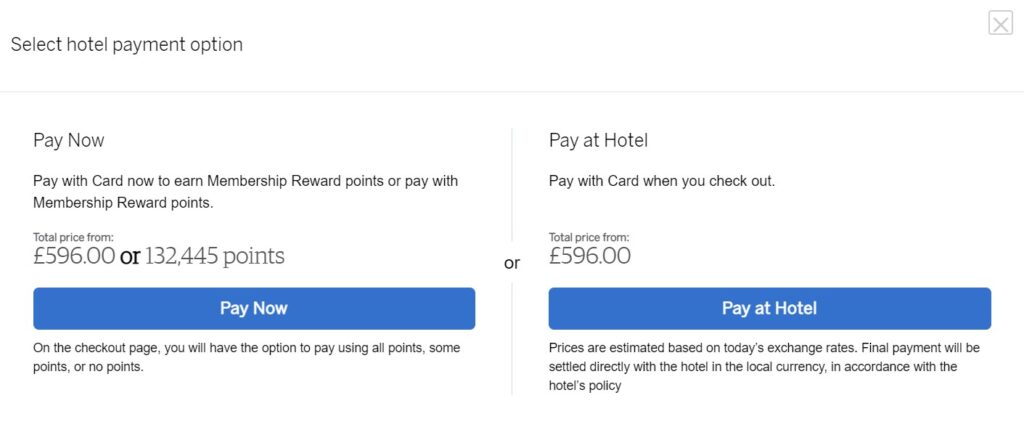

Amex has recently added a new feature to its travel services quietly: you can now prepay your FHR bookings. You will see both options appear when attempting to make an FHR reservation:

Historically Amex doesn’t charge you at all and you just pay at hotel checkout. So what’s point of prepaying for the stay? There can be two possible reasons:

- The payment is taken by Amex Travel, which means if you hold an Amex Gold card at the same time, paying with it earns you triple membership rewards points

- It will also trigger any Amex Travel cashback offers your card may have

A friend of mine has just booked an FHR hotel and prepaid, and he received an email instantly confirming that the current Amex Travel £50 off £200 offer has been triggered.

One thing I’m a bit sceptical is, are such bookings still treated as direct and earn points etc with the hotel’s loyalty program? Hopefully the answer is yes, but we will find out. If you are booking an independent hotel however, it doesn’t make any difference.