Home » Credit Cards » Mastercard

Category Archives: Mastercard

Instant GHA Titanium status with Mastercard

GHA has a long-term partnership with Mastercard, allowing cardholders in Asia Pacific for an instant status match. Geographically it might not fit the majority of our audience, but it’s worth a refresher.

If you have a Mastercard World Elite issued in Asia Pacific, you can claim GHA Titanium status by registering at the Mastercard redemption portal. Note that they now verify full card number, expiry date and CVV so you must have a valid card, although they don’t run a name check.

Despite that I have an eligible card, this approach doesn’t work as I couldn’t see the GHA match offer in my account. There’s an alternative though – you could register with Mastercard Travel & Lifestyle Services, link the card and email [email protected] for a manual match.

After two days I received a response along with a link to activate my Titanium status, which came through and is valid till the end of 2025!

I don’t stay at GHA hotels often at all, but when I do the double upgrade and 4pm late checkout are very useful.

Claim your free wifi before boarding a flight

Etihad is very stingy about their onboard wifi. Sat in their first class cabin, I’m only given a voucher for 200 MB data which is next to useless, and I’m not willing to pay. Then I saw the Boingo logo on the landing page, remembered my credentials, logged in and it worked!

I almost forgot about the perk: as a cardholder of the Virgin Atlantic Rewards+ credit card I was able to create a complimentary Boingo account. It seems to be the only credit card in the UK that offers this benefit, although certain mastercards issued in other countries should also qualify. To check your eligibility, enter your card details here.

The following airlines welcome Boingo customers on their aircraft (H.T. Prince of Travel):

- Aer Lingus

- American Airlines

- Cathay Pacific

- Etihad Airways

- Japan Airlines

- Lufthansa

- Singapore Airlines

- TAP Air Portugal

- Virgin Atlantic

- WestJet

Boingo’s onboard wifi access used to be unlimited, but was unfortunately cut to 12 90-minute sessions per calendar year, starting from this month. It is still very handy though, and you should be able to use these sessions consecutively on a flight.

Before you travel with these airlines, create a Boingo account using an eligible Mastercard if you have one.

Free airport fast track security with Mastercard

Mastercard has launched a new initiative to its cardholders in Europe, which offers airport fast track security, dining discounts and more.

You can check more details and sign up here. If you are eligible, you are entitled to complimentary fast track service at select airports globally, the list of which can be found here. The following UK airports offer such benefit:

- Aberdeen

- Bristol

- Edinburgh

- Glasgow

- Liverpool

- London Gatwick

- London Luton

- Newcastle

- Southampton

With quite a few other locations across Europe and China.

You can pre-book the fast track security for free if you manage to create an account. In addition, even more airports have restaurants that offer dining discounts, which means you can get say 20% off your bill by scanning a QR code.

Airport transfer is another advertised benefit, although I doubt you can get it for free. These benefits are provided by Dragon Pass, and it’s in fact a well-established business model in China, so they are expanding their credit card partnership to other territories.

Here comes the problem – the website doesn’t tell you which cards are eligible, and there’s no way to tell except for trying it yourself. So far only two UK-issued Mastercard have successful reports:

- Curve

- Currensea

However, it seems that even if you have the right card, you have to be very lucky to be accepted. I have no clue what the trick is. I thought it might be related to the BIN (first 6-digits), but even cards with the same BIN end up differently.

The UK cards appear to come with three complimentary fast track visits per year. Interestingly, there are successful reports from Chinese cards too, with even more generous offer:

- Bank of China – four complimentary visits annually

- China Merchants Bank – unlimited visits

- SPD Bank – unlimited visits with one guest

Amusingly, upon registration the website suggests that the card issuing country is Belgium or Spain, which is obviously wrong. It’s unclear which cards are actually intended for this program, but their backend system is definitely buggy.

If you have a Mastercard, whether issued in Europe or not, you may want to give it go and be in for a surprise. I’ve tried all my UK and US cards and nothing works unfortunately 🙁

(H.T. Headforpoints)

How to redeem your Virgin Atlantic Credit Card Upgrade voucher

Virgin Atlantic Reward+ Credit Card is probably the best non-Amex traveller card in the UK, and the Tier Reward after hitting £10,000 annual spend is quite attractive. One of the rewards to choose from is an upgrade voucher, and I’ll talk about how to use it today.

[Receiving the Voucher]

First of all, you should receive the voucher within 30 days of spending the qualifying amount. You won’t receive an email or see it in your Virgin Atlantic account, but you’ll see the following row in the activity statement:

You don’t need to specifically choose from the three Tier Rewards, instead whenever you are ready you can just redeem straightaway.

[Facts]

The voucher can be used on both revenue and reward tickets. This is a big advantage over the BA upgrade voucher issued by Barclaycard.

Only Virgin Atlantic operated flights are upgradable. Economy Light tickets are non-upgradable.

The voucher can be used to upgrade a return flight or two one-way flights. You can use half of the voucher on a one-way flight and save the other half for the future.

You can upgrade one-cabin, i.e. Economy to Premium or Premium to Upper Class.

Reward availability is required in the upgraded cabin.

You need to pay the difference in taxes and charges.

The voucher cannot be redeemed online. You must call the contact centre to redeem it.

It can be applied on tickets issued by travel agencies too – you don’t have to book directly from Virgin Atlantic, which is good as they don’t have best rate guarantee.

You can redeem the voucher for someone else – you don’t have to travel.

[Calculating the charges]

To know how much you need to pay for the upgrade is easy. Say that you want to upgrade a one-way flight from London to Miami, then just search any date for that route on Virgin’s website. Select a flight and cabin then you’ll see ticket price on the next page:

See Taxes, fees and charges? It’s not the whole picture though, you must click the link to view the actual breakdown, which will show you the carrier-imposed surcharge too:

The two numbers combined are payable charges for a reward ticket. And in this case:

- Economy: £120 + £169 = £289

- Premium: £120 + £270 = £390

- Upper Class: £350 + 270 = £620

Which means you must pay £101 for upgrading from Economy to Premium, or £230 from Premium to Upper Class.

[Using the Voucher]

The first thing you need to ensure is reward availability in the cabin you want to upgrade to. Since Virgin Atlantic doesn’t guarantee reward seats on any flight, you may need to search their website often or subscribe to one of the alerting services.

Once you find it:

- For reward ticket, you don’t need an existing booking, simply call in to make the booking with points and voucher

- For revenue ticket, you don’t need any Virgin points, just call in to upgrade with the voucher

Since fuel surcharges are sky high at the moment, upgrading a revenue ticket usually turns out a much better deal.

Virgin Atlantic actually has a Gold service line which isn’t publicised on their website. However if you are a Gold member you should be able to find the 0800 number in any newsletter they sent you. I wasn’t aware and just called the regular number at 7pm on Wednesday. It took 25 minutes to get through, which wasn’t too bad.

The agent could see reward availability and my upgrade voucher no problem. She asked for my credit card details to pay the £230 charge, which is identical to my calculations above.

It’d be nice to be able to redeem the voucher online, but overall the contact centre experience was smooth and positive, and I think paying £230 for an upgrade to Upper Class, plus finally finding a use for that voucher feels really good!

Match to Preferred Hotels Authority for free upgrade, breakfast and lounge access with Mastercard World Elite

We wrote about Preferred Hotels’ program update last year, as well as the status match opportunity to Elite with Mastercard at that time. The promotion has got even better now.

You could check out the offer on Mastercard’s site here. Until January 2023, select Mastercards issued in Asia Pacific qualify for special Preferred Hotels benefits:

- World Elite – match to I Prefer Authority

- Elite – match to I Prefer Elite

- Platinum & Titanium – match to I Prefer Explorer

- Others – 2,500 bonus points upon enrolment

Even if you are familiar with I Prefer, you may have never heard of Authority – it’s a new top-tier status introduced last July, and by invitation only.

Authority privileges include welcome gift, room upgrade, free breakfast and lounge access. It’s more or less on the same level with Hilton Diamond, Marriott Platinum and Hyatt Globalist, which is pretty valuable.

In order to apply for the match, all you need is the BIN (first 6 digits) of a qualifying Mastercard. However, after submitting my application, I received a reply asking me for a photo of my credit card, including the key information.

9Once that’s sorted, you’ll want to create an I Prefer account first. You may use my referral link which will give you a 1,000-point sign-up bonus. My quota is already filled so won’t earn anything myself, but the referred should be fine, and feel free to post your referral link in the comments.

Then you need to send an email to [email protected] with the title Mastercard Offer – Authority Tier, content following the template provided on Mastercard’s offer page. You should receive a reply within seven business days, and if approved the status is valid for a year.

Here are some Preferred Hotels in the UK:

- Royal Lancaster, London

- The Bentley, London

- The Beaumont, London

- The Stafford, London

- L’oscar, London

- Sea Containers, London

- The Lowry, Manchester

- The Grand, York

- The Fitzwilliam Hotel, Belfast

And there are plenty more in Europe and all over the world. The match is very easy and benefits are substantial, so it’s worth a few minutes of yours to submit an application. Remember that the status is only valid for one year, so you may want to apply nearer the deadline if you have no immediate travel plans.

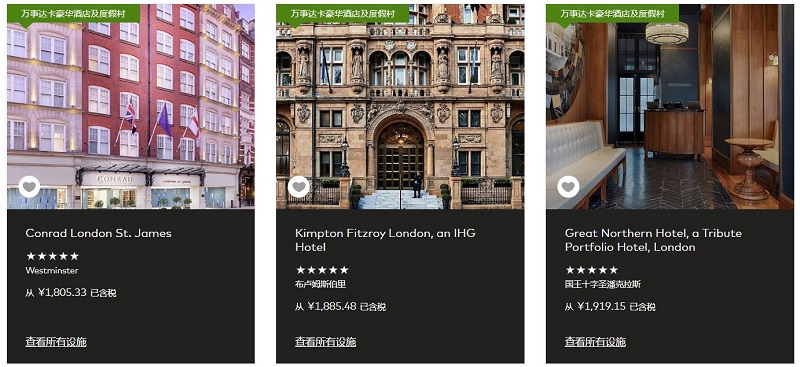

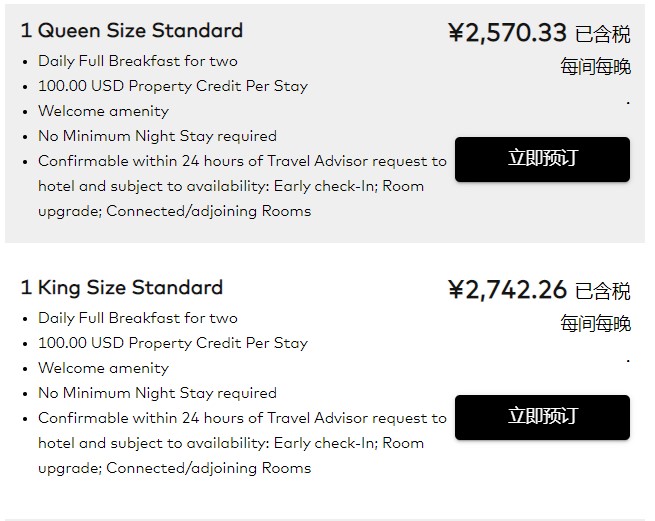

Enjoy free breakfast, room upgrade, $100 credit and more with Mastercard Travel Services

Amex has FHR and Visa has its Luxury Hotel program, and it shouldn’t surprise you that Mastercard runs a similar hotel booking service too.

The service is called Mastercard Travel & Lifestyle, provided by TEN. You must validate your eligibility by entering the card number, and then if approved you could create an account to access more information. It’s unclear what cards are eligible as it’s likely down to the individual contracts between banks and Mastercard, but in general you need a premium card such as the World Elite.

Mastercard World Elite is no longer rare in the UK. I vaguely remember that HSBC Premier World Elite was participating, but it doesn’t work anymore, and I’m not sure if my memory is wrong or the partnership has been withdrawn. My Curve Metal doesn’t work either.

Anyway you should give your Mastercard a go. Finally my China-issued World Elite card works and I gained access to the platform. Similar to Amex they offer priority restaurant reservations and early access to event tickets, but I’ll focus on the hotel-booking part today.

If you perform a hotel search, you’ll see hotels with a green label indicating that they are part of the Mastercard Luxury Hotels collection:

Apologies for the Chinese text and confusing price in CNY – it seems to be bound by the card issuing country and I can’t switch the language or currency.

There are 37 labelled properties in London, and here are some rate / benefit examples:

Their database of room types seems quite messed up, which is very often inconsistent with what the hotels have on their end. However I don’t think it’s a big deal, and you should have an idea what the room type actually is anyway.

As you may have noticed, the benefits can be quite different from one property to the other. In fact if you are a veteran of the hotel games, you probably would know how it works at this point. Yes, unlike Amex Fine Hotels and Resorts, Mastercard doesn’t own its own program. Instead it acts as a travel agency which can book customers into individual hotel chains’ elite rates, such as:

- Hilton Impresario

- IHG Luxury & Lifestyle

- Marriott Stars & Luminous

- Hyatt Prive

I have talked briefly about such programs before. In general all such rates are on par with the Best Flexible Rate and earn points / night credits. In terms of benefits, they all come with room upgrade and late check-out, and on many occasions free breakfast and $50 or $100 on-property credit as well.

Sometimes these programs offer discount too which Mastercard should also be able to provide. For example, both Hilton Impresario and IHG Luxury & Lifestyle offer widely available 3-for-2 deals at the moment. Marriott on the other hand, offers 20% off for stays of three nights or longer at select properties.

You don’t pay anything to Mastercard. At the time of booking you need to provide a credit card as deposit, and then you’ll pay the hotel directly during your stay.

If you have access to the Mastercard Travel Services, I actually think it’s quite worthy of signing up. Its inclusion of so many hotel programs means it covers many more hotels than Amex FHR, and when there’s an offer like 3-for-2 it can be a really sweet deal. Note that you can’t book these rates without an agency – if you don’t have access to Mastercard Travel or similar platforms, you need to find a qualifying travel agent on Google and contact them, which obviously isn’t as easy or quick.

Complimentary Avis President’s Club membership for Mastercard members

Hertz, Avis and Europcar all have different partnerships with hotel groups etc that offer elite status and rent discounts. If you are a customer of Avis, there is now a such chance for free status elevation.

The offer which is through an agreement with Mastercard can be accessed here.

- Mastercard Black and World Elite cardholders receive complimentary President’s Club membership

- Mastercard Platinum, Gold and World or Business cardholders receive complimentary Preferred membership

Use the link on the page and the respective passcode shown to sign up. There doesn’t appear to be any verification though, unless I have missed something.

(EDIT: you do need to link your account with a Mastercard although I don’t know if they verify the card type too. If you have an Amex card, try the passcode Centurion instead.)

I don’t drive myself so can’t really comment on how useful the status would be. But from what I understand Preferred is a free scheme which anyone can sign up to. President’s Club seems to be the sweet spot as you can expect a single or double upgrade at least.

Free vouchers from Amazon Music Unlimited and Mastercard

A couple of more offers from Amazon today.

First up is a new incentive for joining Amazon Music Unlimited. If you are eligible (haven’t signed up to the Unlimited service recently), you are entitled to a £5 Amazon voucher if signing up to a 30-day free trial. The offer ends August 4, and remember to cancel your subscription if you don’t want to pay after 30 days.

And a joint offer from Amazon and Mastercard. If eligible you’ll receive a £10 promotional voucher once you’ve switched your 1-click setting to a Mastercard. There’s no code needed and it’ll apply to your next purchase automatically.