Home » Credit Cards (Page 2)

Category Archives: Credit Cards

Claim your free wifi before boarding a flight

Etihad is very stingy about their onboard wifi. Sat in their first class cabin, I’m only given a voucher for 200 MB data which is next to useless, and I’m not willing to pay. Then I saw the Boingo logo on the landing page, remembered my credentials, logged in and it worked!

I almost forgot about the perk: as a cardholder of the Virgin Atlantic Rewards+ credit card I was able to create a complimentary Boingo account. It seems to be the only credit card in the UK that offers this benefit, although certain mastercards issued in other countries should also qualify. To check your eligibility, enter your card details here.

The following airlines welcome Boingo customers on their aircraft (H.T. Prince of Travel):

- Aer Lingus

- American Airlines

- Cathay Pacific

- Etihad Airways

- Japan Airlines

- Lufthansa

- Singapore Airlines

- TAP Air Portugal

- Virgin Atlantic

- WestJet

Boingo’s onboard wifi access used to be unlimited, but was unfortunately cut to 12 90-minute sessions per calendar year, starting from this month. It is still very handy though, and you should be able to use these sessions consecutively on a flight.

Before you travel with these airlines, create a Boingo account using an eligible Mastercard if you have one.

My review of No.77 First Class Lounge, Shanghai Pudong

Shanghai is a city that you won’t miss when visiting China, and it is very likely that you’ll pass by the Pudong Airport, which in the main international travel hub of Shanghai. Despite having grown up close-ish to Shanghai, I haven’t travelled through Pudong many times and it is my first time flying an international route today.

Etihad Airways uses Terminal 2 of PVG, and contracts with the China Eastern First Class No. 77 Lounge. There is another No. 69 Lounge at Terminal 2, but words are it’s a lot worse.

The name may sound strange, but it is a very common way to name airport lounges in China. They are very often just called No. XX First Class Lounge, where XX is the nearest boarding gate. I find it not bad as locating the lounge is made super easy.

As you have guessed, China Eastern is the main sponsor of the lounge, although it’s also the contract lounge for dozens of other airlines. It is operated by Plaza Premium, which means you can enter for free with any Amex Platinum card.

My departure is in late December, and at this time China’s international travel is still pretty much non-existent. There are very few passengers in the lounge, and some areas are shut because of that.

There are some big sofas when you enter. This area is far from the dining area which makes it a lot quieter.

Going in, there are some open-plan rooms on the left, and armchairs on the right.

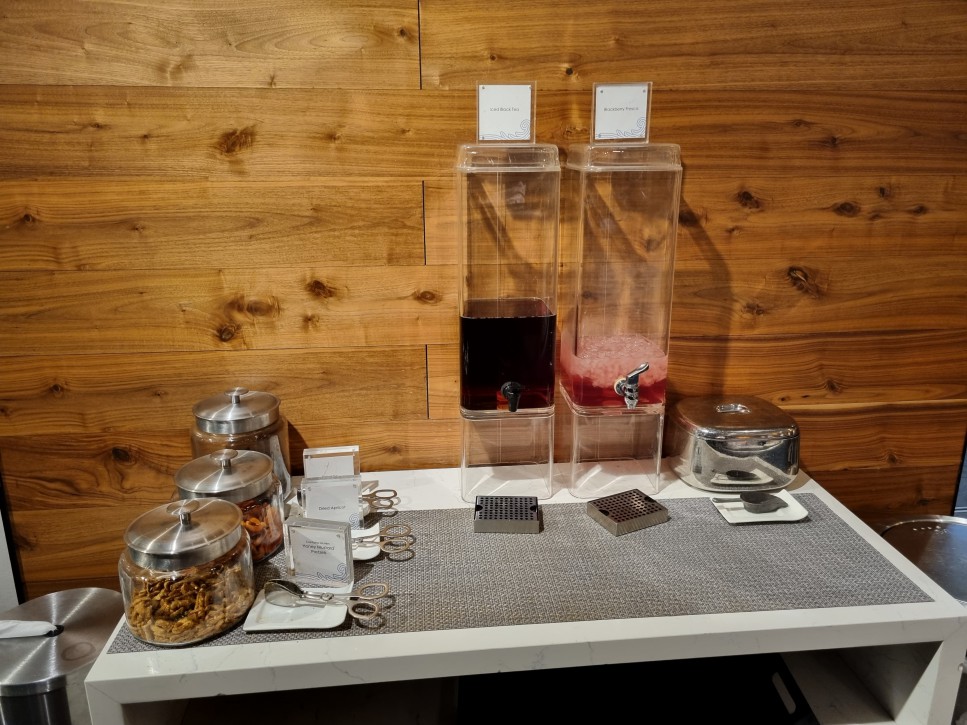

There’s a kitchen a buffet area at the very end of the lounge. The buffet is decent, with the following options available on the day:

- Braised beef with red wine

- Grilled fish with chillies

- Oyster mushrooms

- Fish tofu with Thai sauce

- Laoganma fried rice

- Pasta

- Buns

- Sour and spicy soup

- Sweet potato soup

Drinks and snacks:

China Eastern lounges are famous for their signature noodles, and I ordered one with high expectations. It turns out that they have outsourced catering to a third-party supplier at the moment unfortunately, and the noodles are very disappointing.

The No. 77 China Eastern First Class Lounge at Pudong Airport isn’t an outstanding lounge, but the catering is decent (and should have improved since China ended all the restrictions), and you can get in with an Amex Platinum card or DragonPass.

Unboxing HSBC’s LUXURY thank you gift!

(The original post was submitted by a friend and published here. This is my attempt to coarsely translate it!)

I applied and was approved for the HSBC Elite Credit Card (US-issued) last year, which comes with an annual fee of $395.

One main incentive for me to apply for this card was the mysterious Luxury Thank You Gift – each year when you spend $50K, $75K and $100K on the card you will earn a “surprise luxury gift”, a suspense or marketing trick they’ve created for this product.

I did my research using Google and going through all the blogs and forums, yet shockingly couldn’t find any answer to what the gift actually is. Even the customer representatives from HSBC knew no more than “it’s something from Tiffany”, which was why I started putting a lot spend through the card out of curiosity.

I finally reached all three targets in November 2022, and was looking forward to the arrival of my gifts!

It was a long wait as they needed to courier the gifts to China, but I received the package in February 2023 eventually.

They are indeed Tiffany boxes as expected!

My three gifts are shipped in the same package, with a lovely thank-you card in each of them.

Hold your breath while I reveal the grand LUXURY gifts!!!

This is definitely not something that I had expected or hoped for. So it turns out that each gift is pair of Tiffany wine glasses, and I got a package of six. Don’t forget that I spent $100,000 in order to receive them!

They look much better IN the boxes.

The retail price is $125 per pair on Tiffany’s website.

If you’ve been wondering what the luxury thank you gifts are from the HSBC elite credit card, now you have the answer. Whether it is worth spending at least $50,000 annually will be totally up to you😉

25% off, 3-for-2 and more offers with Amex Fine Hotels & Resorts

You are probably familiar with American Express’s Fine Hotels and Resorts Program – Platinum and Centurion cardholders can book select luxury hotels at the Best Flexible Rate, and enjoy benefits including free breakfast, room upgrade, 4pm checkout and $100 on-property credit.

Even better, Amex FHR has launched a sale to sweeten the deal. On top of the aforementioned perks, some hotels are making an additional offer, for example:

- 25% off room rate

- 30% off suite bookings

- Complimentary 3rd or 4th night

- Extra on-property credit

The offer page is dedicated to the U.S. market, but the offer is global. I signed in with my UK Platinum card and could see the same deals. Not many UK / European hotels are participating, but here are some examples:

- Baglioni Hotel London 3for2 / $535

- Waldorf Astoria Edinburgh 25% off / $221

- Conrad Dublin 3for2 / $260

- Mandarin Oriental Prague 3for2 / $286

Rates are in USD and exclude taxes. Remember that they all come with $100 credit to spend at the hotel, so WA Edinburgh is exceptional value for a one-night stay.

There are even more great offers in Asia Pacific, and to name a few:

- Conrad Tokyo – 3for2 / $452

- Conrad Osaka – 25% off / $403

- Mandarin Oriental Hong Kong – 3for2 / $326

- Shangri-La Singapore – 4for3 / $254

- Shangri-La Sydney – 4for3 / $285

- Conrad Maldives Rangali Island – 25% off / $900

If staying with a hotel chain, you are still entitled to the usual elite benefits and points accrual. You also have the option to pre-pay, which may earn you additional Amex MR points.

Hilton: double night credit offer, 30% Amex UK conversion bonus

In addition to its double points global offer, Hilton has launched another double night credit promotion which makes it easier to attain elite status and potentially earn even more bonus points.

- Stay between October 11 and December 31

- Earn double elite night credit for all stays

- It counts towards Milestone Bonuses and Rollover Nights too

As usual, both paid and award nights can trigger the bonus. Existing bookings prior to registration count too, so there’s no need to cancel and rebook.

Your check-in / check-out date doesn’t matter, but only nights falling into the promotion period earn bonuses. For example, if you check in on October 9 and check out on October 12, only the last night is eligible.

It’s a nice gesture to make them count towards Milestone Bonuses, which means if you are approaching or above 40 nights, you earn 10,000 bonus points for every 5 nights stayed, on top of all the other promotions.

Last but not least, although not 100% official, multiple people received confirmation from CS that the bonus counts towards Diamond Challenge too – which means you only need six nights for the Diamond status.

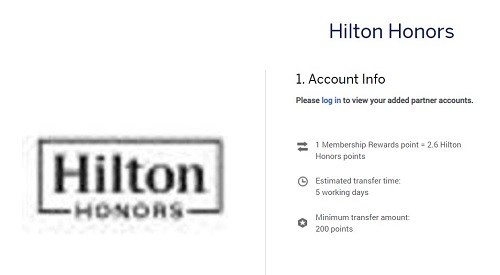

Meanwhile Amex UK started a conversion bonus recently which has totally gone under the radar. You get a 30% bonus when converting Membership Reward points to Hilton by November 3, which means 1 MR point = 2.6 Hilton points.

In my opinion it’s still not a great ratio, but if you need some Hilton points right now or you’ve been saving up for a Maldives trip, it could work out in your favour.

Free airport fast track security with Mastercard

Mastercard has launched a new initiative to its cardholders in Europe, which offers airport fast track security, dining discounts and more.

You can check more details and sign up here. If you are eligible, you are entitled to complimentary fast track service at select airports globally, the list of which can be found here. The following UK airports offer such benefit:

- Aberdeen

- Bristol

- Edinburgh

- Glasgow

- Liverpool

- London Gatwick

- London Luton

- Newcastle

- Southampton

With quite a few other locations across Europe and China.

You can pre-book the fast track security for free if you manage to create an account. In addition, even more airports have restaurants that offer dining discounts, which means you can get say 20% off your bill by scanning a QR code.

Airport transfer is another advertised benefit, although I doubt you can get it for free. These benefits are provided by Dragon Pass, and it’s in fact a well-established business model in China, so they are expanding their credit card partnership to other territories.

Here comes the problem – the website doesn’t tell you which cards are eligible, and there’s no way to tell except for trying it yourself. So far only two UK-issued Mastercard have successful reports:

- Curve

- Currensea

However, it seems that even if you have the right card, you have to be very lucky to be accepted. I have no clue what the trick is. I thought it might be related to the BIN (first 6-digits), but even cards with the same BIN end up differently.

The UK cards appear to come with three complimentary fast track visits per year. Interestingly, there are successful reports from Chinese cards too, with even more generous offer:

- Bank of China – four complimentary visits annually

- China Merchants Bank – unlimited visits

- SPD Bank – unlimited visits with one guest

Amusingly, upon registration the website suggests that the card issuing country is Belgium or Spain, which is obviously wrong. It’s unclear which cards are actually intended for this program, but their backend system is definitely buggy.

If you have a Mastercard, whether issued in Europe or not, you may want to give it go and be in for a surprise. I’ve tried all my UK and US cards and nothing works unfortunately 🙁

(H.T. Headforpoints)

My review of American Express Centurion Lounge, Seattle

I wrote about the Amex Centurion Lounge at Denver which wasn’t very impressive. There’s one in Seattle as well, and I’m gonna give it another try after having spent some time in the nice Sky Club.

It’s just one minute away from the Sky Club, with a very recognisable entrance.

Bad news upon entry: the lounge is already full. But fortunately I don’t have to wait long as I’m on my own.

It is indeed very crowded:

But I’m assigned a pretty comfortable seat.

There’s also some reserved seating which are presumably for Centurion members.

A couple of more photos of the decoration.

More seats are available in the bar area, but still limited.

All alcohol drinks, including cocktails are free.

The buffet menu for hot food:

- Spicy collard greens

- Carolina beef grifts

- Grilles asparagus

Again I’m a bit disappointed at the quality of this lounge, and neither of the two Amex Centurion lounges that I’ve visited in the States are anywhere near the standard of the London one.

Apply for a US Amex card via Global Transfer

[Background]

The credit card market in the United States is way more competitive than anywhere else in the world, and as a result the payment cards offer substantially higher bonuses and better benefits than, say, the UK. Take American Express as an example, it’s not uncommon to see the same card hands out 3x the sign-on bonus plus better day-to-day perks.

Interested in getting a card in the US? It’s actually much easier than you think. First of all you don’t have to be a Resident Alien (I still find the term very amusing) to be eligible, although you do usually need to have a tax identification number, i.e. SSN or ITIN. They are similar to the National Insurance number in the UK, and you need to provide them when submitting a credit application.

There are workarounds though, especially with American Express. We wrote about its Credit Passport feature a while back which approves your US credit card application using your UK credit history. In fact there’s an even easier route, as long as you are already an Amex customer in another country.

The feature is called Global Transfer, and you can read more about it on Amex’s website. You only need to meet the following criteria to apply:

- Be an existing Amex customer

- Have an address in the destination country to receive the card

- Have a telephone number in the destination country

You don’t need a credit history in the destination country, and in the context of United States, nor do you need SSN or ITIN. It works in a similar fashion with Credit Passport, but utilises your client record with Amex instead, which I imagine is in your favour.

In theory you can global transfer from any country to any other country, as long as Amex does business in both of them. There are few exceptions (such as China) due to local financial regulations.

[Why Global Transfer]

As I’ve just mentioned, Amex cards in the US are much better than the UK counterparts from almost every perspective. It’s critical to choose the right card to start with, as you can only request one via Global Transfer and you’ll be stuck with it for a while. (Anecdotes suggest that you may apply for two card simultaneously if applying by phone).

I started with the Platinum card mainly because they were offering a huge sign-on bonus. Compared to the UK version, the US one has the following advantages:

- Better earning rate (1 point / $1)

- Frequent conversion bonus to airline / hotel programs

- No foreign transaction fee

- Priority pass with +2 guests

- Annual credit for FHR and US airlines

You can also transfer UK membership rewards points to the US one at the current exchange rate.

I don’t see myself holding the US Platinum card in the long term, but as I said it’s just a start point.

[Making an application]

We all love earning referral bonuses, but you can’t do global transfer and refer a friend at the same time. You should start your application on Amex’s website, and some public partner offers work too (for example this one from Resy).

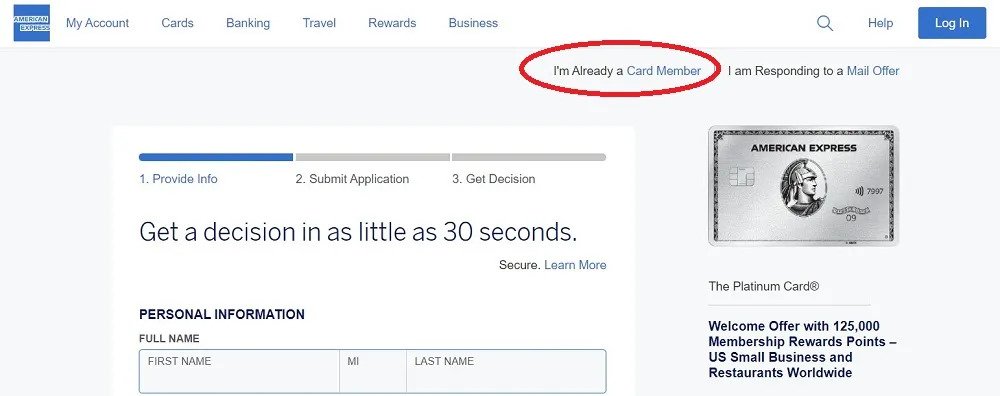

The procedure is quite simple. When applying, click I’m Already a Card Member at the top right:

Sign in using your Amex UK credentials and the form would come back partially pre-filled.

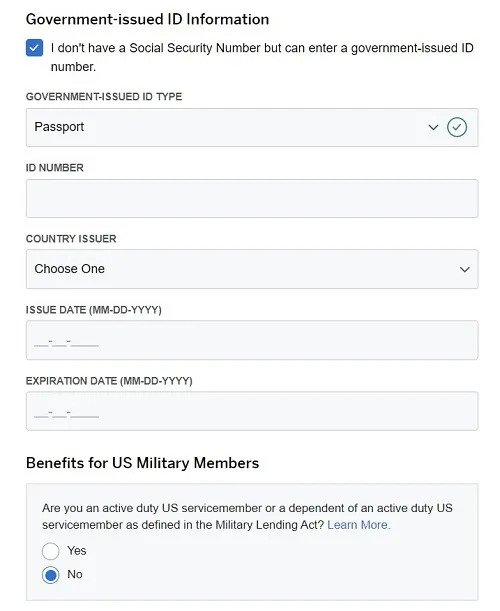

Tick the box declaring that you have no SSN, and fill out the remaining information including your passport number, US address and phone number.

Assuming that you’ve been a great client of Amex, your application should be approved right away.

[Receiving the card]

If you are not physically present at the shipping address, whoever receives the card should forward you the necessary information to activate it.

Since Amex supports Google Pay / Apple Pay, adding the card to your e-wallet should satisfy 99% of your use cases. In the unlikely event that you require a physical card right away, the safest route is probably ask your family/friend to send it across to you.

However, if you have the Platinum card, it’s also legit and straightforward to request a replacement card of an alternative design.

Go to online chat and ask the agent to add an alternate address to your profile, and you can enter your international (UK) address. You could choose a design and request it to be sent to your alternate address in the same conversation. My card arrived in five days.

Since it’s not a lost/stolen situation, the old card remains functional. I’m not sure how long you must wait after card opening to request the replacement though.

[Payment]

Since most (all?) US Amex cards charge no foreign transaction fee, you can use them safely in the UK and abroad. The next question you may have is probably how to make payment, which is surprisingly easy.

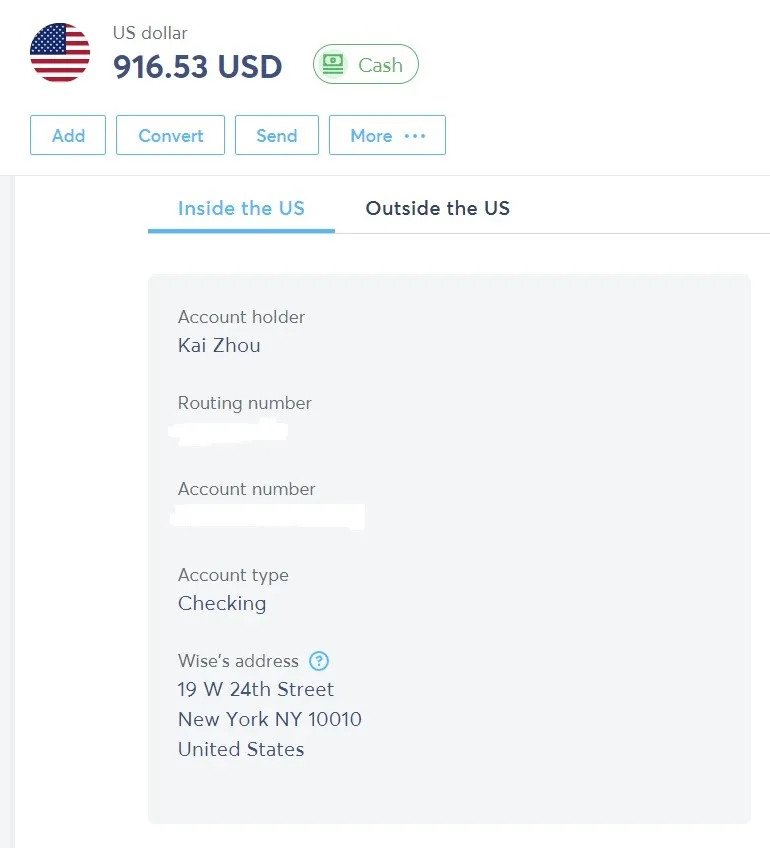

All you need is a Wise (formerly Transferwise) account. Once registered you can open a USD Personal Checking Account. They might need to verify your identity (e.g. UK driving license) which shouldn’t be a problem.

With the routing number and account number, you can link your Wise account in Amex online banking. It doesn’t work like Direct Debit in the UK though – every month after your billing date you still need to log in to Amex online banking and click a button to pull funds from Wise.

You can transfer your GBP funds in a UK bank to Wise’s USD account very easily. The exchange rate is favourable, and the handling fee is only about 0.3%.

If you are new to Wise, feel free to support us by using my referral link which gives you a fee-free transfer of up to €500.

[Conclusion]

I believe that’s all the essential information you need to know now. Once you’ve built up enough history with Amex, you can start applying for more cards, but that story is for another day.