Home » Credit Cards » Visa

Category Archives: Visa

Use BA’s companion voucher on Iberia flights

I was never a fan of the British Airways Premium Plus Amex card, mainly because I was, for the most time, a solo traveller. Its companion voucher went through a major overhaul in 2022 though which made it much more appealing, and I will take a close look it today.

The Travel Together Ticket issued by the Chase British Airways Visa Signature card is, as far as I know, exactly the same, so the following discussions hold for both.

To earn the companion voucher, you need to spend £10,000 in a card year. The voucher is issued right after you’ve met the spending criteria, and valid for two years from that date.

- Applies to redemption tickets on BA, EI and IB metal

- The cardholder must travel

- The origin can be anywhere

- Works on one-way, return and open-jaw itineraries

- Works on all cabin classes

- Save 50% in Avios for one or two persons

- Full taxes and charges are still payable

There are two major improvements: firstly, solo travellers can use it for 50% discount; secondly, it’s extended to Iberia and Aer Lingus flights too.

Unfortunately due to the constant efforts of BA to devalue Avios, long-haul redemptions are, very often, no longer very good in value even when the voucher is applied. For short-haul redemptions the math works out better, but in absolute terms you aren’t saving a lot.

The best way to use this voucher lies with Iberia, as they have a very generous redemption chart.

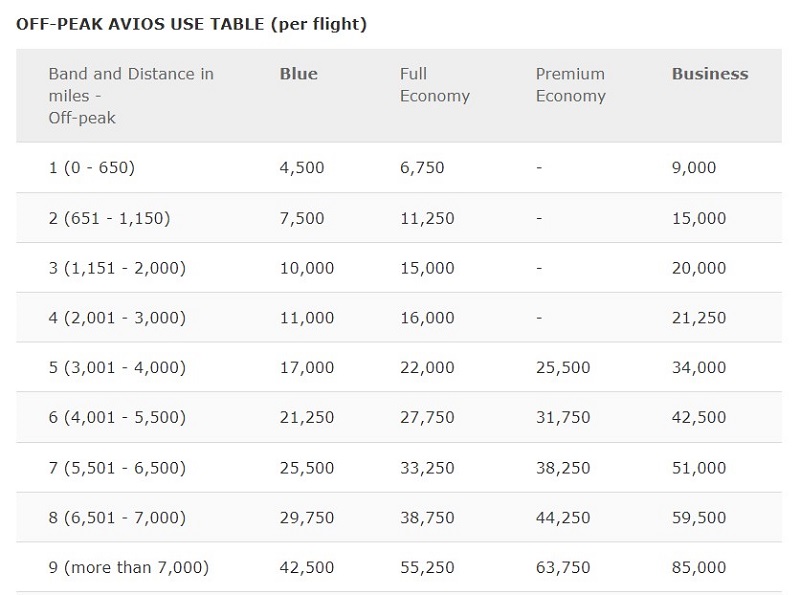

A one-way flight from Madrid to New York, in business class, costs only 34,000 Avios. For South America it’s 42,500 or 51,000 Avios. This is incredibly cheap compared to BA.

Taxes and fees are also very reasonable. For Madrid – Buenos Aires return it costs 102,000 Avios + £236.30 – superb value! Note that the chart above is for off-peak dates, and it will cost more in peak season.

With the companion voucher applied, departing from Madrid in off-peak season, you will pay the following figures for a return trip per person:

- New York – 34,000 Avios + £215.60

- Bogota – 42,500 Avios + £224.20

- Buenos Aires – 51,000 Avios + £236.30

Note that you need to book on ba.com rather than iberia.com to use the voucher. You could add your positioning flight to / from Madrid in the same booking with the 50% discount applied too. However:

- Don’t add London – Madrid to the same booking, otherwise it incurs the hefty APD

- Don’t mix with BA flights, otherwise it increases the cost significantly

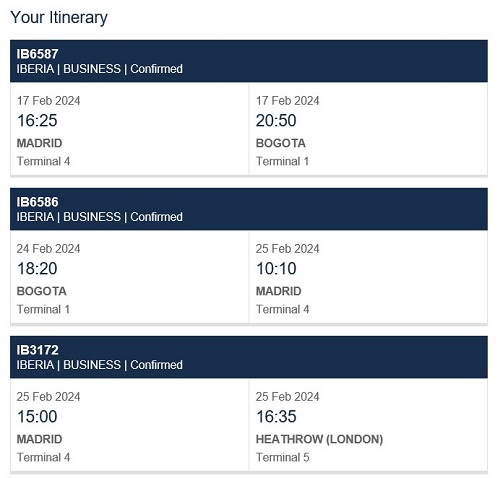

My recommendation is to book e.g. Madrid – New York – Madrid – London using the voucher, and then sort out London – Madrid separately. Here’s my trip to Bogota:

It costs 48,875 Avios + £244. As it’s an open-jaw booking, it’s not possible to do it online – confirm online that there’s availability and then call BA to book it, mentioning that you want to use the companion voucher.

Unboxing HSBC’s LUXURY thank you gift!

(The original post was submitted by a friend and published here. This is my attempt to coarsely translate it!)

I applied and was approved for the HSBC Elite Credit Card (US-issued) last year, which comes with an annual fee of $395.

One main incentive for me to apply for this card was the mysterious Luxury Thank You Gift – each year when you spend $50K, $75K and $100K on the card you will earn a “surprise luxury gift”, a suspense or marketing trick they’ve created for this product.

I did my research using Google and going through all the blogs and forums, yet shockingly couldn’t find any answer to what the gift actually is. Even the customer representatives from HSBC knew no more than “it’s something from Tiffany”, which was why I started putting a lot spend through the card out of curiosity.

I finally reached all three targets in November 2022, and was looking forward to the arrival of my gifts!

It was a long wait as they needed to courier the gifts to China, but I received the package in February 2023 eventually.

They are indeed Tiffany boxes as expected!

My three gifts are shipped in the same package, with a lovely thank-you card in each of them.

Hold your breath while I reveal the grand LUXURY gifts!!!

This is definitely not something that I had expected or hoped for. So it turns out that each gift is pair of Tiffany wine glasses, and I got a package of six. Don’t forget that I spent $100,000 in order to receive them!

They look much better IN the boxes.

The retail price is $125 per pair on Tiffany’s website.

If you’ve been wondering what the luxury thank you gifts are from the HSBC elite credit card, now you have the answer. Whether it is worth spending at least $50,000 annually will be totally up to you😉

£10 Amazon credit for Barclaycard customers

If you are a Barclaycard customer, there’s now a chance to grab a free £10 Amazon credit.

You can check out the offer details here. Note that according to the terms and conditions you must land on the offer page first before taking part.

- Offer ends September 30

- Pay at least £10 on Amazon with your Barclaycard

- You’ll then receive a £10 voucher to use by October 30

The offer should be open to all Barclaycard customers – note that it is Barclays’ credit card division, so debit cards that come with their current account won’t qualify.

Enjoy room upgrade, breakfast, $25 credit and more with Visa Luxury Hotel Collection

As a frequent traveller I’m sure you have heard of Amex Fine Hotels & Resorts, Hilton Impresario and Hyatt Prive etc. They are all dedicated VIP hotel booking programs which provide special channels for you to book high-end hotels with additional benefits.

However, these programs are not open to everyone – Amex FHR requires you to have an Amex Platinum or Centurion card, and for the others you must book via a qualified travel agent which is a bit of a hassle. Also such hotels aren’t usually cheap.

There is actually an alternative provided by Visa, which is much more widely accessible. The program is called Visa Luxury Hotel Collection, and you could try it out here.

You can expect the following benefits when booking via VLHC:

- Free breakfast daily

- $25 in hotel credit per stay

- Free wi-fi

- Room upgrade subject to availability

- 3pm late checkout subject to availability

They are not as good as FHR, since the credit is only $25 (v.s. $100), and late checkout is not guaranteed. VLHC also offers Best Rate Guarantee which is currently suspended – the rate usually is just the Best Flexible Rate though so I doubt you’ll need it.

First of all, as long as you have a Visa card you should be able to book, unlike Amex FHR. Although VLHC is supposed to be reserved for Visa premium cardholders, I tried my pleb Barclays debit card and it worked.

Secondly, VLHC covers many hotels that are relatively cheaper. Have a look at some hotels in London:

- The May Fair / £217

- The Stratford Hotel / £135

- Andaz London Liverpool Street / £199

- Conrad London St James / £225

You don’t typically see London FHR hotels going for under £300. You should always check all portals though as the hotel may offer significantly lower rate for booking direct (albeit without breakfast and $25 credit).

The main sweet spots are in Asia. Some Conrad / InterContinental / Hyatt hotels in China can be had for sub-£100, and if you head to Indonesia and Thailand, even under £50. These hotels are way too cheap to be placed in FHR, Impresario, LuxLife or Prive, thus booking a one-night stay with VLHC represents true value especially if you don’t have elite status with the hotel chain.

Similar to FHR, VLHC also runs complimentary-night offers. Some the current offers include:

- Shangri-la the Shard, London / Complimentary 4th night

- Mandarin Oriental, Barcelona / Complimentary 3rd night

- Park Hyatt, New York / Complimentary 3rd night

- Shangri-la, Singapore / Complimentary 3rd night

Compared to FHR, VLHC doesn’t provide as substantial benefits if you already hold elite status with the hotel chain. However, if you don’t have the elite status, have no access to FHR or are travelling in Asia, it can still provide you with some good value.

Instant Indulged upgrade with Small Luxury Hotels

Small Luxury Hotels, or SLH, is yet another boutique hotels group with a decent spread worldwide. You may have heard the name from its connection with the Hyatt hotels that started a couple of years ago.

SLH has its own loyalty program as well, and members can enjoy some benefits when booking direct:

- Invited entry level with complimentary wi-fi, early check-in and late check-out upon request

- Inspired four nights per annum, with complimentary breakfast and room upgrade subject to availability thrown in

- Indulged thirteen nights per annum, with a free night voucher upon attaining status and invitation-only events

SLH runs quite a few promotions in collaboration with different organisation that gift you Inspired status straightaway without meeting the stay requirement. Even better, there’s even a chance for instant upgrade to Indulged, their top-level status.

You could view the offer page here. Through this offer, HSBC Jade members can enjoy a complimentary upgrade to Indulged courtesy of a special arrangement. HSBC Jade is a semi-secretive client tier within the bank, and you won’t get in unless you are very wealthy. However, this offer doesn’t require any validation – simply login or create a new account on the page, and the upgrade should take effect right away.

It worked for me briefly, and then dropped to Inspired a few days later 🤷♂️ To be fair, the stay benefits between Inspired and Indulged look almost identical.

Remember that you can also book SLH hotels through Hyatt, difference being:

- Not all SLH hotels are bookable through Hyatt

- Only Best Flexible Rate is available on Hyatt, whereas many discount rates on SLH

- Earn Hyatt points, or $300 voucher for every 12 nights with SLH

- Stay benefits are pretty much the same on paper, however I’d expect Indulged / Globalist members fare better with regards to room upgrade

Related Read:

Amazon Music Unlimited 4-Month Trial via HSBC

A good deal is just out for HSBC Visa cardholders to enjoy some free music streaming. You can see the details on HSBC’s page here.

To be eligible, you need to:

- Have an HSBC Visa card

- Haven’t used Amazon Music Unlimited service before (trial or paid)

Just head to this page on Amazon Music, change your payment method to the Visa card and then sign up. You’ll receive a 30-day free trial first, and then promotional credit equal to the following three months’ fee will be applied to your subscription. Remember to cancel your subscription in time if you don’t want to pay.

First Direct and M&S bank are HSBC subsidiaries, so their Visa cards have a decent chance of being eligible too. If it’s been a while since you last used Amazon Music Unlimited, you may also find yourself lucky.

If you do not have any of these Visa cards, you can still enjoy a free trial of three months by signing up here. Note that it is also for new customers only.