My review of American Express Centurion Lounge, Seattle

I wrote about the Amex Centurion Lounge at Denver which wasn’t very impressive. There’s one in Seattle as well, and I’m gonna give it another try after having spent some time in the nice Sky Club.

It’s just one minute away from the Sky Club, with a very recognisable entrance.

Bad news upon entry: the lounge is already full. But fortunately I don’t have to wait long as I’m on my own.

It is indeed very crowded:

But I’m assigned a pretty comfortable seat.

There’s also some reserved seating which are presumably for Centurion members.

A couple of more photos of the decoration.

More seats are available in the bar area, but still limited.

All alcohol drinks, including cocktails are free.

The buffet menu for hot food:

- Spicy collard greens

- Carolina beef grifts

- Grilles asparagus

Again I’m a bit disappointed at the quality of this lounge, and neither of the two Amex Centurion lounges that I’ve visited in the States are anywhere near the standard of the London one.

My review of Delta Sky Club, Seattle

I’m finished with my Seattle trip, and will be flying with Delta for the first time. I read some good things about the Sky Club at Seattle and I’m very excited in trying it out.

The Sky Club is located at Concourse A and hard to miss. All concourses are connected post-security, so although my flight departs from Concourse S it doesn’t stop me from visiting the lounges.

According to Virgin Atlantic’s website, I’m entitled to Sky Club access automatically when flying back to the UK on Delta as a Flying Club Gold member. My boarding pass fails the scanner though, then the staff go on a little discussion before telling me Delta’s partnership with Virgin has terminated a couple of days ago?!

I’m so astonished and know that’s impossible. After exchanging a few words I realise that they are talking about Virgin Australia. Anyway they don’t seem well trained on the reciprocal benefits, and I decide to just flash my Amex Platinum instead. This time it works like a charm.

An array of lenticular cards by the entrance.

The Seattle lounge is generally regarded as the best Sky Club that Delta has. The lounge is huge with two floors, and leaves a very good first impression on me.

Seattle is one of Delta’s main hubs, but the lounge is not as busy as I thought.

Further down the line is more workspace.

A view of Delta aircrafts.

Some memorabilia of Seattle SeaHawks, an American Football team sponsored by Delta.

The second (first) floor:

The upper floor is quieter, but food is only offered downstairs.

The following hot food is on offer:

- Ivar’s clam chowder with bacon

- Spicy tofu stir fry

- Steamed brown rice

- Roasted green beans

- Teriyaki chicken

If you haven’t got to taste Seattle’s specialty Clam Chowder yet, there is one last chance! The Teriyaki chicken isn’t cooked right and tastes salty instead of sweet, but I actually prefer it this way.

A limited selection of beer and wine is complimentary, but most alcoholic drinks are payable. I read somewhere that redeeming Delta miles on Champagne is a good idea, but I didn’t check.

Desserts:

The chewy marshmallow looks very similar to a Chinese snack that I liked when I was a kid.

The bathroom might have been inspired by a few horror movies…

I want to take a look at the Amex Centurion lounge as well so didn’t spend all the time here. The Seattle Sky Club didn’t disappoint me, and is well worth a couple of hours before your flight.

My review of Kimpton Monaco Seattle

Hotels in the US tend to be expensive, which is why I prefer to splash some of my points here. It doesn’t seem easy in Seattle however, as there aren’t many options to start with. Hilton redemption values are poor, whereas Marriott and IHG may have a dozen of options combined.

I didn’t find anything that’s near ideal, but went with the Kimpton Monaco hotel eventually. 107,000 points for two nights isn’t cheap, but the hotel is quite well located, and it’s right after the new IHG One benefits came into effect so I want to see how it plays out.

The Monaco brand appears to be a chain itself, as it’s present in other cities like Washington DC, Philadelphia and Pittsburgh. The Seattle one is very close to the University Street station, so around half an hour by train to the airport.

The building looks quite tired, and to be honest the W opposite doesn’t look any younger.

The lobby has an Arabic style.

To my disappointment the hotel restaurant is operating at limited capacity and isn’t open during my stay, which means I can’t choose breakfast as a Diamond welcome amenity. However they are running a special promotion, so I’ve got 600 welcome points + 5,000 bonus points instead.

(I forgot to say the Kimpton password :()

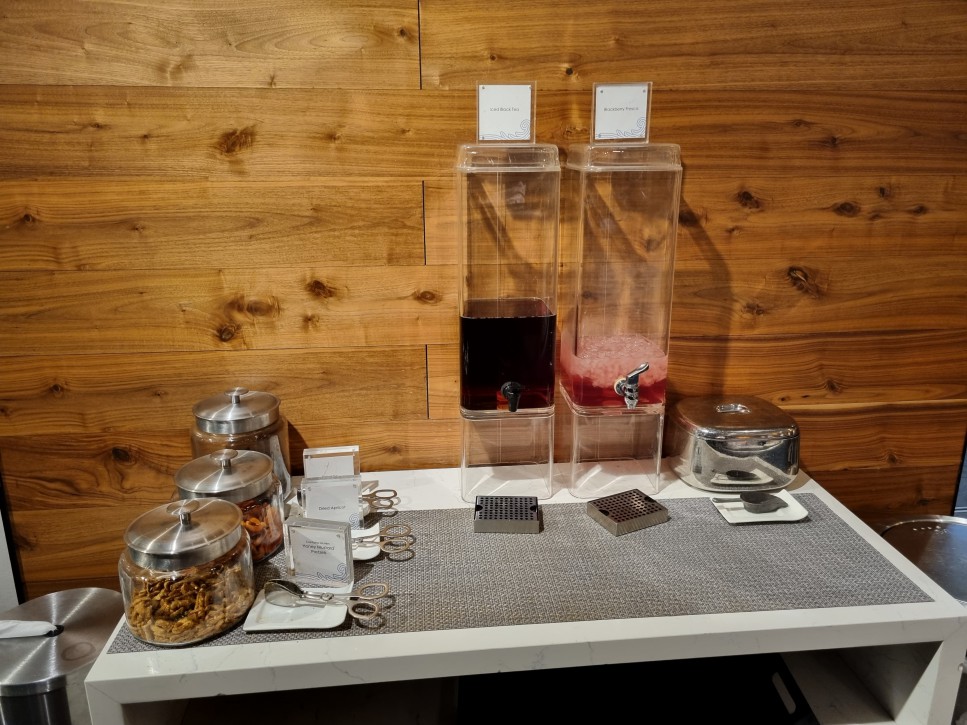

There’s a small refuel corner in the lobby for snacks and drinks. If you choose the $20 welcome credit instead you can spend it here.

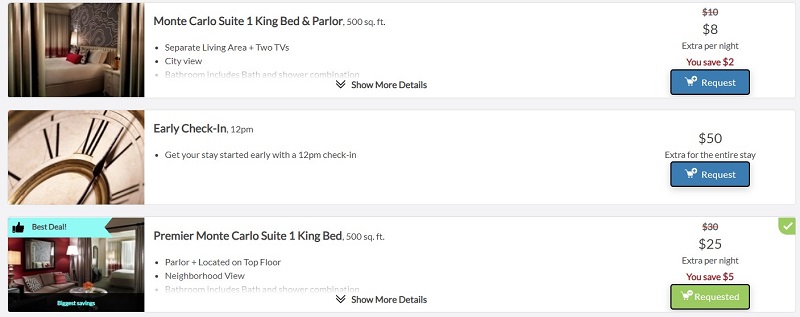

eStandby was offered online on IHG’s website. The suite upgrade offers are very attractive, and I opted for Premier Monte Carlo Suite which costs only $25 per night. It’s the second-best suite this hotel has (there’s an Ambassador Suite which you must consult the hotel directly for booking).

The top three floors (9, 10 and 11 if I remember correctly) are the so-called Premier Floors. It’s similar to what some hotels have as an Executive Floor – no tangible benefits, but only a dedicated express elevator.

It’s actually a big room split into a living room and a bedroom by a curtain, so not a proper suite in the real sense.

This is the living room with sofa, desk and TV.

And the bedroom:

Nothing to see here in downtown Seattle.

The drapes aren’t black-out at all, which annoys me in the morning.

One thing I like about the UK Kimptons is that all rooms have a yoga mat. I didn’t find one here though so I guess it’s not a global standard.

What they do offer is a daily happy hour (6pm-7pm), which means free drinks for all hotel guests.

I don’t recall if you can order cocktails (for free) too, but from the display I guess it’s possible.

It’s a nice touch of the Kimpton brand.

There’s a gym at the lower ground level.

The hotel advertises a destination fee but I wasn’t charged, not sure if it’s due to the restaurant not open or me booking with points. My total bill is the $50 for eStandby upgrade (no extra taxes).

When I checked out I mentioned the 5,000 promotion points didn’t hit my account. The manager told me it’s actually misinformation and the promotion is double points (1,200 points) or double credit ($40), but since I was told so they’d acknowledge it and award me the bonus.

Two weeks after I checked out there’s still no sign of the 5,000 points and I had to raise it with IHG’s customer care. It was confirmed again – and to my surprise a batch of three 5,000 bonus points landed at my IHG account a couple of days later. I guess they were just a bit slow 🙂

My review of Seattle Marriott Bellevue

I need to stay four nights in Seattle, and following my friend’s advice I chose to split the stay and spend the first two nights in Bellevue. It’s also because I found a good Marriott deal – two nights at the Seattle Marriott Bellevue hotel costs only 48,000 points.

Departing from the airport, there was some traffic going into Seattle and it took 40 minutes to get to the hotel. The hotel is about 10 minutes’ walk away from the downtown park which isn’t too bad. The Westin and W are more centrally located, but more expensive too.

According to their website, most rooms are more or less the same, and one of the main differences is the presence or absence of a bath tub. I expressed my preference for a room with bath tub, but then it turns out to be a quest – no one has any idea what rooms that would be.

They have to turn so many pages before finally assigning me a room. Then I make all the way to it only to find no tub in the bathroom at all. I have to go back to reception and they start another investigation, but this time they send a housekeeper to check the room first, and I eventually get what I wanted.

From what I understand they don’t have suites at this property, and what I’ve got – a high-floor, mountain view Executive room – is the best in their inventory.

The room is okay although nothing inspiring.

When the sky clears up – not very often during my stay in Seattle – you can see the mountains. The Westin and W presumably have better views as they are much taller.

To my disappointment, the bath tub is so tiny and low that you’d be lucky to fit a kid in it. I truly can’t figure out its purpose.

The previous room I entered has a microwave, but it’s not available in this one.

The M Club just re-opened the Sunday before.

Soft drinks and snacks are available throughout the day. I don’t think there’s any arrangement in the evening though.

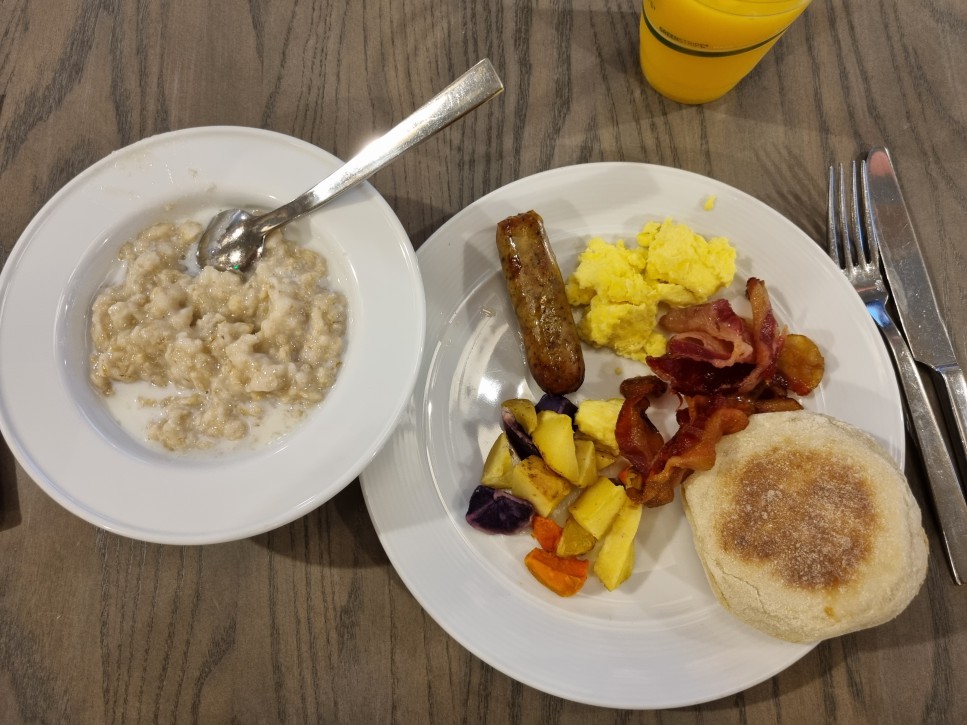

Elite breakfast is served in the M Club.

Although there are a few hot items served, the quality is very underwhelming.

The hotel has no swimming pool, but a gym.

In summary, the Seattle Marriott Bellevue is just about acceptable and nothing more. If you want to spend your Marriott points and are on budget, it’s one of the better options in and around Seattle.

How to accrue 60 nights annually via Marriott credit cards only

(Warning: I must admit first that this is a clickbait, as although practically possible very few people qualify for all the credit cards required 😉)

Marriott issues co-branded credit cards in many markets including the US and UK, and one major perk of them is elite night credits which is awarded annually to accelerate your membership tier upgrade process. Usually such credits are not stackable across multiple cards, but there are rare combinations that work.

Up until recently, the maximum annual credits you can possibly accrue was 30 nights, by holding:

- A Marriott personal card (15 nights), e.g. Amex UK, Amex US or Chase US, and

- An Amex US Marriott business card (15 nights)

You can only stack one personal card with one business card, otherwise having two personal cards (e.g. Amex US & UK) only yields 15 night credits.

There was an Amex SPG card in Japan which offered another stackable 5 nights, but that card has been re-branded to give 15 nights instead which no longer works.

There has been a very recent development though. Citic Bank just started issuing the first Marriott co-branded credit cards in China this week. It comes with three versions that offer 5, 10 and 15 elite night credits respectively.

Terms say that you can only apply for one of the three cards, and the night credits don’t stack with credit cards issued by other banks. However in reality it works slightly differently: people have reported to be able to submit three applications, and whilst they are all pending, all night credits have already hit the Marriott account – and that’s on top of what’s offered by other banks.

Sorry that I don’t have a screenshot in English, but this is from someone who’s just applied for all three cards and he’s already had the US Marriott Amex card. The four cards have deposited a total of 45 nights into his account.

This could well be an error (especially as those credit applications aren’t even approved yet) and will possibly be fixed soon. But in theory, at the moment you can harvest 60 night credits for this year which gives you Platinum status straightaway, if you are eligible for credit applications in both US and China of course.

Apply for a US Amex card via Global Transfer

[Background]

The credit card market in the United States is way more competitive than anywhere else in the world, and as a result the payment cards offer substantially higher bonuses and better benefits than, say, the UK. Take American Express as an example, it’s not uncommon to see the same card hands out 3x the sign-on bonus plus better day-to-day perks.

Interested in getting a card in the US? It’s actually much easier than you think. First of all you don’t have to be a Resident Alien (I still find the term very amusing) to be eligible, although you do usually need to have a tax identification number, i.e. SSN or ITIN. They are similar to the National Insurance number in the UK, and you need to provide them when submitting a credit application.

There are workarounds though, especially with American Express. We wrote about its Credit Passport feature a while back which approves your US credit card application using your UK credit history. In fact there’s an even easier route, as long as you are already an Amex customer in another country.

The feature is called Global Transfer, and you can read more about it on Amex’s website. You only need to meet the following criteria to apply:

- Be an existing Amex customer

- Have an address in the destination country to receive the card

- Have a telephone number in the destination country

You don’t need a credit history in the destination country, and in the context of United States, nor do you need SSN or ITIN. It works in a similar fashion with Credit Passport, but utilises your client record with Amex instead, which I imagine is in your favour.

In theory you can global transfer from any country to any other country, as long as Amex does business in both of them. There are few exceptions (such as China) due to local financial regulations.

[Why Global Transfer]

As I’ve just mentioned, Amex cards in the US are much better than the UK counterparts from almost every perspective. It’s critical to choose the right card to start with, as you can only request one via Global Transfer and you’ll be stuck with it for a while. (Anecdotes suggest that you may apply for two card simultaneously if applying by phone).

I started with the Platinum card mainly because they were offering a huge sign-on bonus. Compared to the UK version, the US one has the following advantages:

- Better earning rate (1 point / $1)

- Frequent conversion bonus to airline / hotel programs

- No foreign transaction fee

- Priority pass with +2 guests

- Annual credit for FHR and US airlines

You can also transfer UK membership rewards points to the US one at the current exchange rate.

I don’t see myself holding the US Platinum card in the long term, but as I said it’s just a start point.

[Making an application]

We all love earning referral bonuses, but you can’t do global transfer and refer a friend at the same time. You should start your application on Amex’s website, and some public partner offers work too (for example this one from Resy).

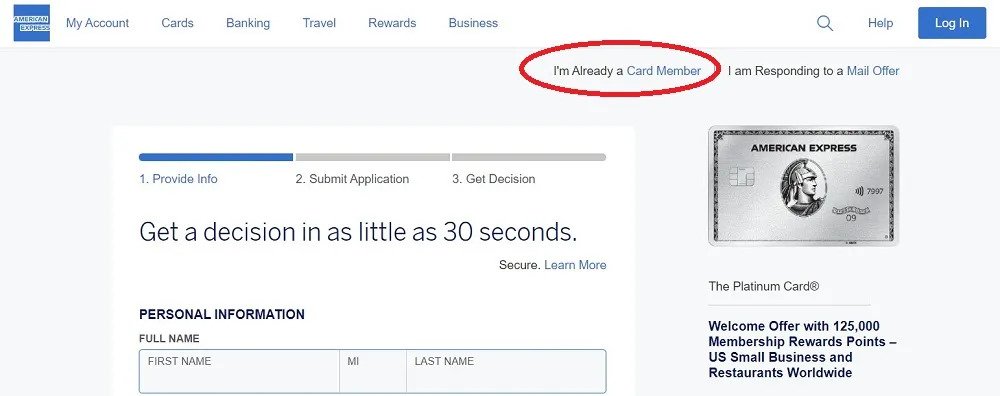

The procedure is quite simple. When applying, click I’m Already a Card Member at the top right:

Sign in using your Amex UK credentials and the form would come back partially pre-filled.

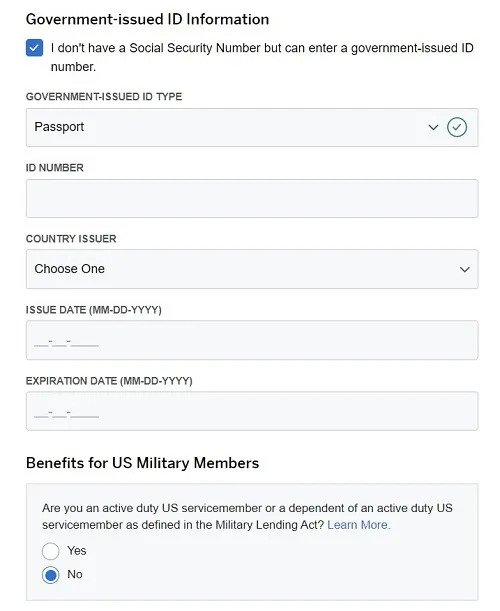

Tick the box declaring that you have no SSN, and fill out the remaining information including your passport number, US address and phone number.

Assuming that you’ve been a great client of Amex, your application should be approved right away.

[Receiving the card]

If you are not physically present at the shipping address, whoever receives the card should forward you the necessary information to activate it.

Since Amex supports Google Pay / Apple Pay, adding the card to your e-wallet should satisfy 99% of your use cases. In the unlikely event that you require a physical card right away, the safest route is probably ask your family/friend to send it across to you.

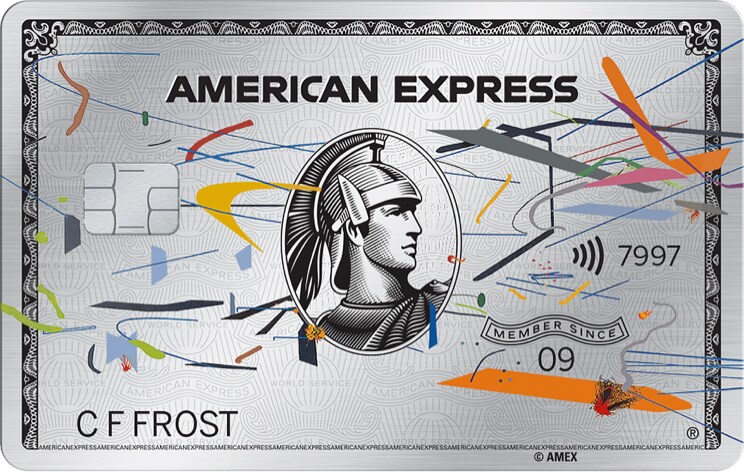

However, if you have the Platinum card, it’s also legit and straightforward to request a replacement card of an alternative design.

Go to online chat and ask the agent to add an alternate address to your profile, and you can enter your international (UK) address. You could choose a design and request it to be sent to your alternate address in the same conversation. My card arrived in five days.

Since it’s not a lost/stolen situation, the old card remains functional. I’m not sure how long you must wait after card opening to request the replacement though.

[Payment]

Since most (all?) US Amex cards charge no foreign transaction fee, you can use them safely in the UK and abroad. The next question you may have is probably how to make payment, which is surprisingly easy.

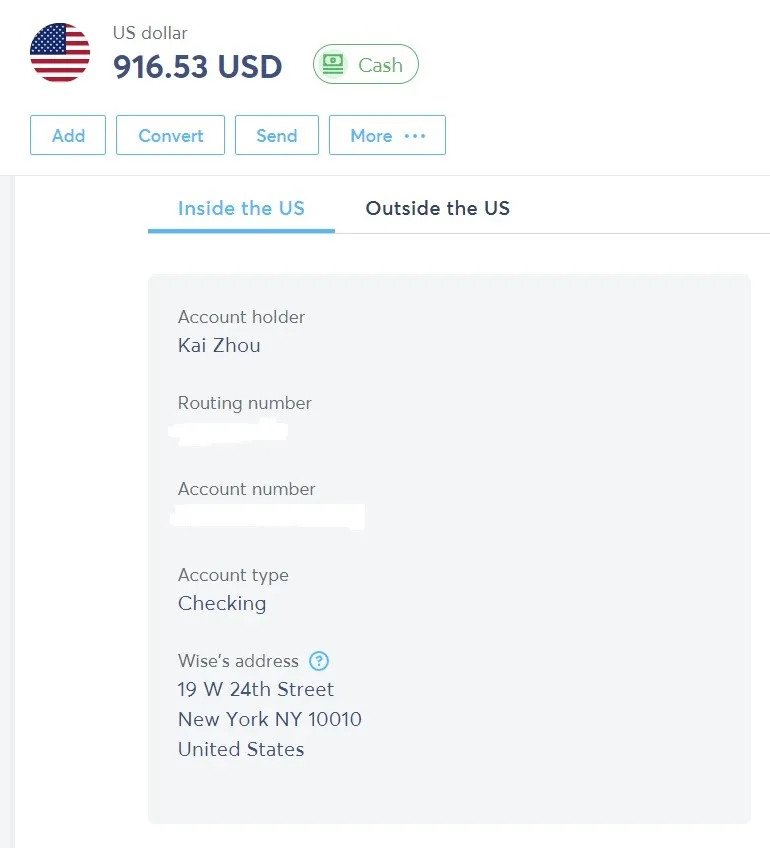

All you need is a Wise (formerly Transferwise) account. Once registered you can open a USD Personal Checking Account. They might need to verify your identity (e.g. UK driving license) which shouldn’t be a problem.

With the routing number and account number, you can link your Wise account in Amex online banking. It doesn’t work like Direct Debit in the UK though – every month after your billing date you still need to log in to Amex online banking and click a button to pull funds from Wise.

You can transfer your GBP funds in a UK bank to Wise’s USD account very easily. The exchange rate is favourable, and the handling fee is only about 0.3%.

If you are new to Wise, feel free to support us by using my referral link which gives you a fee-free transfer of up to €500.

[Conclusion]

I believe that’s all the essential information you need to know now. Once you’ve built up enough history with Amex, you can start applying for more cards, but that story is for another day.

My review of Amex Centurion Lounge, Denver

I’ve had the Amex Platinum card since 2014, but it’s not until now have I visited an Amex Centurion lounge in the States. I was actually in Miami the other day which also has a Centurion lounge, however at the wrong terminal and airside inter-terminal transfer was not possible so I missed the opportunity there.

It’s not an issue in Denver thankfully, so although my Delta flight departs from a different Concourse I’m still able to access the Centurion lounge in Concourse C. I just need to take the shuttle train from Concourse A to C and then back after my visit.

The Centurion lounge is near Gate 46, take the escalator up once you see the sign.

Platinum cardholders can guest up to two people, so I’m able to bring my friend with me. Note that starting from 2023 US-issued Platinum cards can no longer bring any guests unless they spend at least $75,000 the previous year, whilst cards issued by other countries remain unaffected.

The spending target is pretty high, and the aim is to address the overcrowding problem which is getting worse by the day. Denver is no exception:

The lounge is not huge but has a decent size, so despite being fairly crowded it’s not too difficult to find a seat.

Some areas have a view of the runway of airport interior.

There are a pool table and shuffleboard for fun.

The same decorative wall as I saw in London.

It’s early in the morning, so breakfast service is available. Some of the dishes include eggs, sausages and fried potatoes.

All drinks including cocktails are free at the Centurion lounge, which is an edge over other airline lounges in the United States that makes it different.

You can also make yourself a coffee or orange juice, however it’s pretty hard to spot a free glass anywhere.

In conclusion – I think the lounge itself is more than fine, as the decor is nice and the food offering is okay. The experience is considerably overshadowed by the capacity issue though, which is likely to improve from February next year.

My review of JW Marriott Marquis, Miami

First time in Miami, my plan was to stay a couple of nights in downtown and then one day at the South Beach. Unfortunately there happens to be a tropical storm during my visit, so the South Beach plan was cancelled.

Miami appears to be a good place to burn Marriott points, as there are a bunch of options in downtown between 20,000 and 40,000 points – in fact the Courtyard Coconut Grove costs only 18,000 points a night. After some research I went for the JW Marriott Marquis hotel, which is 40,000 points or $400.

It’s not to be confused with the other JW Marriott nearby, which from what I’ve gathered is an inferior property.

Interestingly, there’s another Marriott inside this hotel. Hotel Beaux Arts from the Autograph Collection occupies floor 38-40 and shares the facilities with the JW Marriott. I don’t assume their guests can access the club lounge though, so you are better off booking the JW Marriott if you have Platinum status or above.

The front desk is very generous to offer me an upgrade to the Executive Suite. Sadly I need a twin bed room, so he arranges us a Bay View Room on the high floor instead.

The room is located on the 35th floor and measures around 500-600 sqft.

The bathroom has both a shower and a bath tub.

Bay view:

And views from other spots in the hotel:

Elite breakfast is served on the second floor at the 345 Restaurant:

Many hotels in the US offer very limited free breakfast to elite members, and there’s Hilton who’s eliminated the benefit and only offers some credit instead. This JW Marriott is not fooling around though – it’s pretty much what you’d expect from a full English breakfast buffet.

Breakfast is served until 11am, and then the club lounge on the 36th floor opens.

Snacks and soft drinks are available throughout the day. Happy hour is hosted between 5.30pm and 7.30pm, with a few canapes both hot and cold.

Alcohols are not free.

Desserts are served between 7.30pm and 10pm.

The hotel has a very impressive sports centre, including a basketball court, ping pong tables and a bowling alley.

The gym is fairly big too.

There’s a rooftop swimming pool on the 19th floor.

A hot tub is also available.

Overall I’m very satisfied with this stay – hotels in the US are usually under par but this JW Marriott didn’t let me down. The room is spacious and functional, the breakfast and club lounge offerings are decent, and the swimming pool is stunning. My only complaint is the $25 destination fee, but I guess I should just get used to this con which is imposed by so many American hotels.