Home » Regions (Page 19)

Category Archives: Regions

Good London deal: 25,000 IHG points for Holiday Inn Bloomsbury on Saturdays

A friend of mine developed a tool for monitoring reward night pricing of multiple hotel chains, and recently added support for IHG hotels in London. It’s all in Chinese and lives within Wechat so I’m not sharing the tool, but I spotted a couple of great deals that are worth mentioning.

Crowne Plaza Kings Cross: 27,000 points for most Sundays from August 7th

Holiday Inn London Bloomsbury: 23,000 points for most Sundays from August 7th, and 25,000 points (or below) for Saturdays starting September 9th

London IHG hotels (as well as many other countries / cities) used to be very cheap point-wise when IHG started to introduce dynamic pricing, but unfortunately it’s no longer the case. It’s nice to see however that great redemption values are not completely gone. (shame on you, Hilton!)

The Holiday Inn Bloomsbury deal is well worth considering in my opinion. It’s not a brilliant hotel, but 25,000 points for a four-star in central London on a Saturday night can’t be sniffed at.

How to accrue 60 nights annually via Marriott credit cards only

(Warning: I must admit first that this is a clickbait, as although practically possible very few people qualify for all the credit cards required 😉)

Marriott issues co-branded credit cards in many markets including the US and UK, and one major perk of them is elite night credits which is awarded annually to accelerate your membership tier upgrade process. Usually such credits are not stackable across multiple cards, but there are rare combinations that work.

Up until recently, the maximum annual credits you can possibly accrue was 30 nights, by holding:

- A Marriott personal card (15 nights), e.g. Amex UK, Amex US or Chase US, and

- An Amex US Marriott business card (15 nights)

You can only stack one personal card with one business card, otherwise having two personal cards (e.g. Amex US & UK) only yields 15 night credits.

There was an Amex SPG card in Japan which offered another stackable 5 nights, but that card has been re-branded to give 15 nights instead which no longer works.

There has been a very recent development though. Citic Bank just started issuing the first Marriott co-branded credit cards in China this week. It comes with three versions that offer 5, 10 and 15 elite night credits respectively.

Terms say that you can only apply for one of the three cards, and the night credits don’t stack with credit cards issued by other banks. However in reality it works slightly differently: people have reported to be able to submit three applications, and whilst they are all pending, all night credits have already hit the Marriott account – and that’s on top of what’s offered by other banks.

Sorry that I don’t have a screenshot in English, but this is from someone who’s just applied for all three cards and he’s already had the US Marriott Amex card. The four cards have deposited a total of 45 nights into his account.

This could well be an error (especially as those credit applications aren’t even approved yet) and will possibly be fixed soon. But in theory, at the moment you can harvest 60 night credits for this year which gives you Platinum status straightaway, if you are eligible for credit applications in both US and China of course.

Apply for a US Amex card via Global Transfer

[Background]

The credit card market in the United States is way more competitive than anywhere else in the world, and as a result the payment cards offer substantially higher bonuses and better benefits than, say, the UK. Take American Express as an example, it’s not uncommon to see the same card hands out 3x the sign-on bonus plus better day-to-day perks.

Interested in getting a card in the US? It’s actually much easier than you think. First of all you don’t have to be a Resident Alien (I still find the term very amusing) to be eligible, although you do usually need to have a tax identification number, i.e. SSN or ITIN. They are similar to the National Insurance number in the UK, and you need to provide them when submitting a credit application.

There are workarounds though, especially with American Express. We wrote about its Credit Passport feature a while back which approves your US credit card application using your UK credit history. In fact there’s an even easier route, as long as you are already an Amex customer in another country.

The feature is called Global Transfer, and you can read more about it on Amex’s website. You only need to meet the following criteria to apply:

- Be an existing Amex customer

- Have an address in the destination country to receive the card

- Have a telephone number in the destination country

You don’t need a credit history in the destination country, and in the context of United States, nor do you need SSN or ITIN. It works in a similar fashion with Credit Passport, but utilises your client record with Amex instead, which I imagine is in your favour.

In theory you can global transfer from any country to any other country, as long as Amex does business in both of them. There are few exceptions (such as China) due to local financial regulations.

[Why Global Transfer]

As I’ve just mentioned, Amex cards in the US are much better than the UK counterparts from almost every perspective. It’s critical to choose the right card to start with, as you can only request one via Global Transfer and you’ll be stuck with it for a while. (Anecdotes suggest that you may apply for two card simultaneously if applying by phone).

I started with the Platinum card mainly because they were offering a huge sign-on bonus. Compared to the UK version, the US one has the following advantages:

- Better earning rate (1 point / $1)

- Frequent conversion bonus to airline / hotel programs

- No foreign transaction fee

- Priority pass with +2 guests

- Annual credit for FHR and US airlines

You can also transfer UK membership rewards points to the US one at the current exchange rate.

I don’t see myself holding the US Platinum card in the long term, but as I said it’s just a start point.

[Making an application]

We all love earning referral bonuses, but you can’t do global transfer and refer a friend at the same time. You should start your application on Amex’s website, and some public partner offers work too (for example this one from Resy).

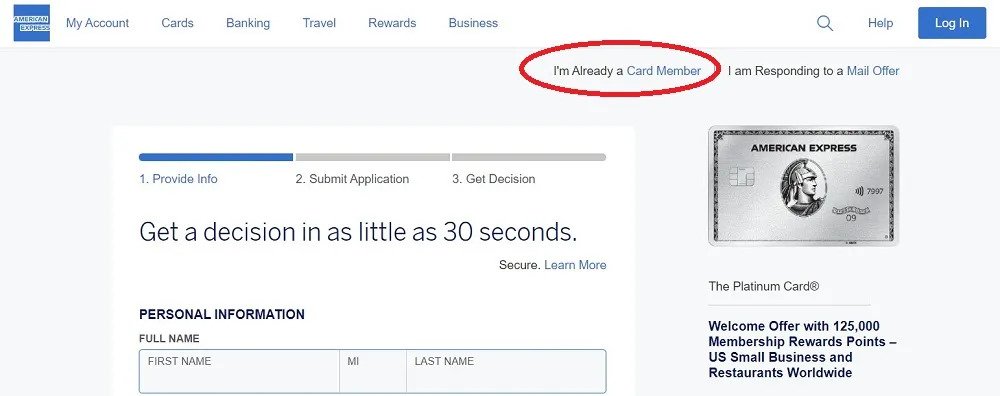

The procedure is quite simple. When applying, click I’m Already a Card Member at the top right:

Sign in using your Amex UK credentials and the form would come back partially pre-filled.

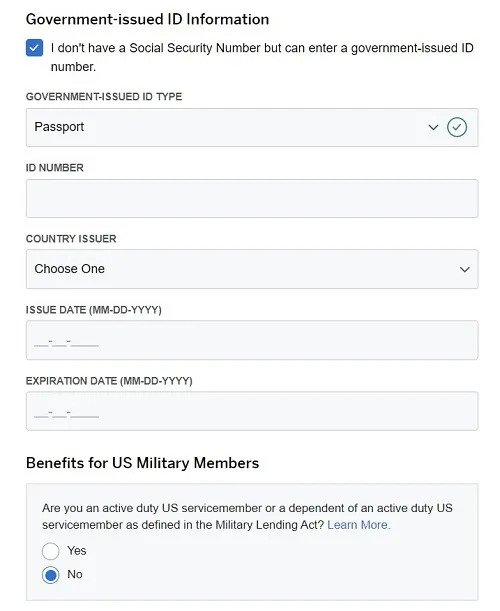

Tick the box declaring that you have no SSN, and fill out the remaining information including your passport number, US address and phone number.

Assuming that you’ve been a great client of Amex, your application should be approved right away.

[Receiving the card]

If you are not physically present at the shipping address, whoever receives the card should forward you the necessary information to activate it.

Since Amex supports Google Pay / Apple Pay, adding the card to your e-wallet should satisfy 99% of your use cases. In the unlikely event that you require a physical card right away, the safest route is probably ask your family/friend to send it across to you.

However, if you have the Platinum card, it’s also legit and straightforward to request a replacement card of an alternative design.

Go to online chat and ask the agent to add an alternate address to your profile, and you can enter your international (UK) address. You could choose a design and request it to be sent to your alternate address in the same conversation. My card arrived in five days.

Since it’s not a lost/stolen situation, the old card remains functional. I’m not sure how long you must wait after card opening to request the replacement though.

[Payment]

Since most (all?) US Amex cards charge no foreign transaction fee, you can use them safely in the UK and abroad. The next question you may have is probably how to make payment, which is surprisingly easy.

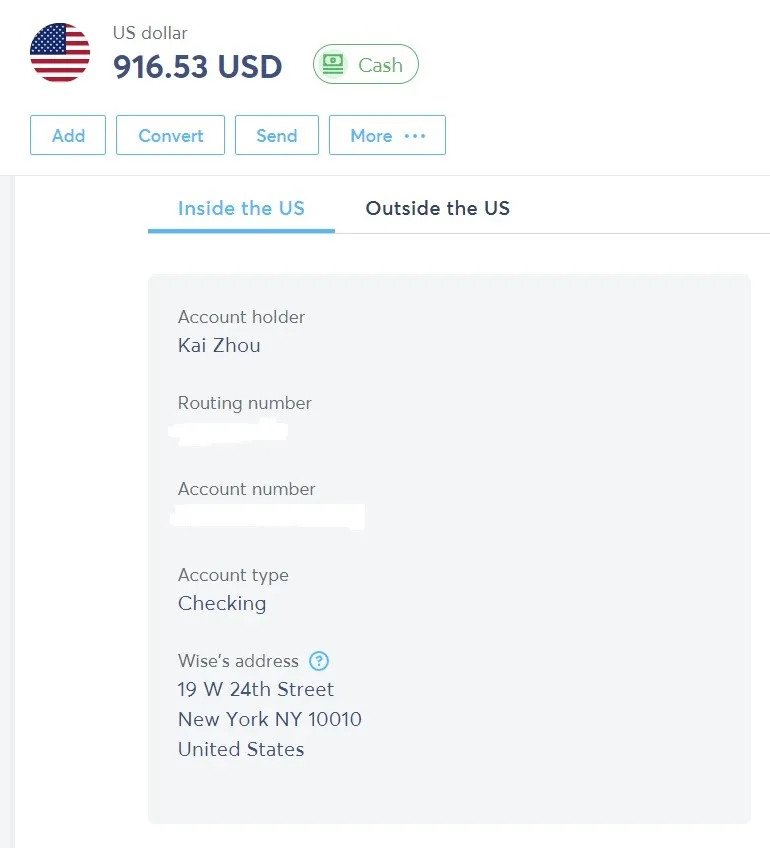

All you need is a Wise (formerly Transferwise) account. Once registered you can open a USD Personal Checking Account. They might need to verify your identity (e.g. UK driving license) which shouldn’t be a problem.

With the routing number and account number, you can link your Wise account in Amex online banking. It doesn’t work like Direct Debit in the UK though – every month after your billing date you still need to log in to Amex online banking and click a button to pull funds from Wise.

You can transfer your GBP funds in a UK bank to Wise’s USD account very easily. The exchange rate is favourable, and the handling fee is only about 0.3%.

If you are new to Wise, feel free to support us by using my referral link which gives you a fee-free transfer of up to €500.

[Conclusion]

I believe that’s all the essential information you need to know now. Once you’ve built up enough history with Amex, you can start applying for more cards, but that story is for another day.

My review of Amex Centurion Lounge, Denver

I’ve had the Amex Platinum card since 2014, but it’s not until now have I visited an Amex Centurion lounge in the States. I was actually in Miami the other day which also has a Centurion lounge, however at the wrong terminal and airside inter-terminal transfer was not possible so I missed the opportunity there.

It’s not an issue in Denver thankfully, so although my Delta flight departs from a different Concourse I’m still able to access the Centurion lounge in Concourse C. I just need to take the shuttle train from Concourse A to C and then back after my visit.

The Centurion lounge is near Gate 46, take the escalator up once you see the sign.

Platinum cardholders can guest up to two people, so I’m able to bring my friend with me. Note that starting from 2023 US-issued Platinum cards can no longer bring any guests unless they spend at least $75,000 the previous year, whilst cards issued by other countries remain unaffected.

The spending target is pretty high, and the aim is to address the overcrowding problem which is getting worse by the day. Denver is no exception:

The lounge is not huge but has a decent size, so despite being fairly crowded it’s not too difficult to find a seat.

Some areas have a view of the runway of airport interior.

There are a pool table and shuffleboard for fun.

The same decorative wall as I saw in London.

It’s early in the morning, so breakfast service is available. Some of the dishes include eggs, sausages and fried potatoes.

All drinks including cocktails are free at the Centurion lounge, which is an edge over other airline lounges in the United States that makes it different.

You can also make yourself a coffee or orange juice, however it’s pretty hard to spot a free glass anywhere.

In conclusion – I think the lounge itself is more than fine, as the decor is nice and the food offering is okay. The experience is considerably overshadowed by the capacity issue though, which is likely to improve from February next year.

My review of JW Marriott Marquis, Miami

First time in Miami, my plan was to stay a couple of nights in downtown and then one day at the South Beach. Unfortunately there happens to be a tropical storm during my visit, so the South Beach plan was cancelled.

Miami appears to be a good place to burn Marriott points, as there are a bunch of options in downtown between 20,000 and 40,000 points – in fact the Courtyard Coconut Grove costs only 18,000 points a night. After some research I went for the JW Marriott Marquis hotel, which is 40,000 points or $400.

It’s not to be confused with the other JW Marriott nearby, which from what I’ve gathered is an inferior property.

Interestingly, there’s another Marriott inside this hotel. Hotel Beaux Arts from the Autograph Collection occupies floor 38-40 and shares the facilities with the JW Marriott. I don’t assume their guests can access the club lounge though, so you are better off booking the JW Marriott if you have Platinum status or above.

The front desk is very generous to offer me an upgrade to the Executive Suite. Sadly I need a twin bed room, so he arranges us a Bay View Room on the high floor instead.

The room is located on the 35th floor and measures around 500-600 sqft.

The bathroom has both a shower and a bath tub.

Bay view:

And views from other spots in the hotel:

Elite breakfast is served on the second floor at the 345 Restaurant:

Many hotels in the US offer very limited free breakfast to elite members, and there’s Hilton who’s eliminated the benefit and only offers some credit instead. This JW Marriott is not fooling around though – it’s pretty much what you’d expect from a full English breakfast buffet.

Breakfast is served until 11am, and then the club lounge on the 36th floor opens.

Snacks and soft drinks are available throughout the day. Happy hour is hosted between 5.30pm and 7.30pm, with a few canapes both hot and cold.

Alcohols are not free.

Desserts are served between 7.30pm and 10pm.

The hotel has a very impressive sports centre, including a basketball court, ping pong tables and a bowling alley.

The gym is fairly big too.

There’s a rooftop swimming pool on the 19th floor.

A hot tub is also available.

Overall I’m very satisfied with this stay – hotels in the US are usually under par but this JW Marriott didn’t let me down. The room is spacious and functional, the breakfast and club lounge offerings are decent, and the swimming pool is stunning. My only complaint is the $25 destination fee, but I guess I should just get used to this con which is imposed by so many American hotels.

Accor extending status again in China… Should you take a punt?

Accor has just published a fast track offer in China, and more importantly, the announcement to extend status expiry again.

All Accor members whose account address is in Greater China (mainland China, Hong Kong, Macau and Taiwan) will have their elite status expiry extended to December 31, 2023. The change will be reflected in July.

Compared to Europe and the Americas, Covid restrictions are still relatively uptight in most Asian countries and they are not ready to welcome international tourists yet. China is obviously the worst – this year it has been unthinkable for many to even travel outside the city they live in, as the circumstances can become extremely complicated once your origin or destination has a single Covid case.

As a consequence, it’s impossible for most Chinese members to retain their status this year. Questions have been raised whether the hotel chains will extend status again this year, although most people weren’t optimistic, Accor has come to surprise us.

The question is, will others follow suit? Given their track records in the last two years I don’t think it’s that unlikely, especially for Hilton who made a few very fast moves.

I have changed my Marriott’s address back to one in China just in case, and might do with the other programs too. Beware that the current IHG fast track promotion isn’t open to residents of Greater China, so if you’re signed up don’t mess up.

What are the benefits of UK American Express Centurion card?

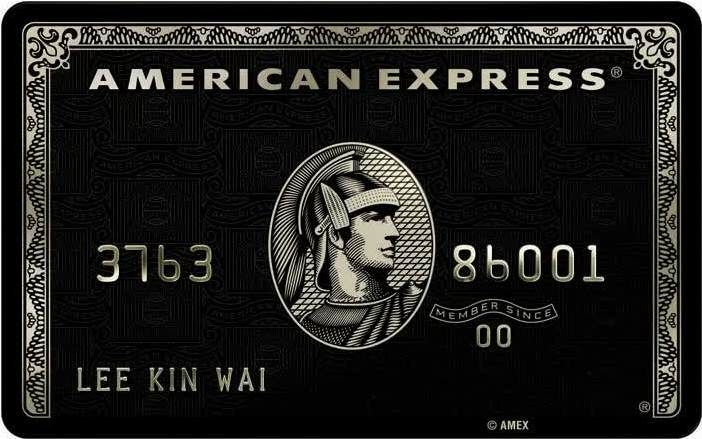

A friend of mine has just received his UK Amex Centurion card. Usually nicknamed the Black Card by the public, it is probably the most prestigious bank card out there, and very few people are eligible to even receive an invitation to apply. Still, many people – just like me – are very curious about its eligibility criteria and benefits, and I’ll take this chance to briefly talk about them.

[Background]

First of all, my friend already has the US Amex Centurion card. Having been a customer with both Amex US and Amex UK, he was quite frustrated with the difficulty to obtain a Centurion card in the UK, and shifted all his spend to the US Amex cards from late 2020.

He spent roughly two million dollars over a span of eight months, and then successfully received an invitation to apply for the Centurion card after querying the Platinum Concierge services.

Interestingly, he is based in the UK and none of the two million dollar purchases was made in the US.

[Get the UK card]

If you already hold the US Centurion card, you can acquire one in other countries through Amex Global Transfer services. It’s a privilege of the US card though, as Centurion members in other countries can’t acquire a US card through the same procedure.

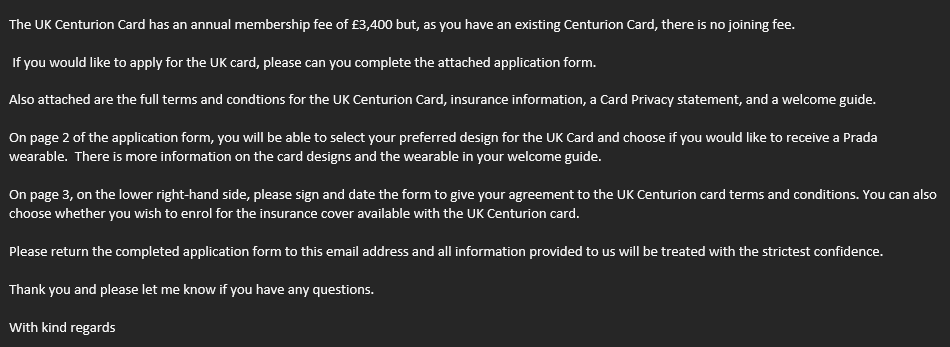

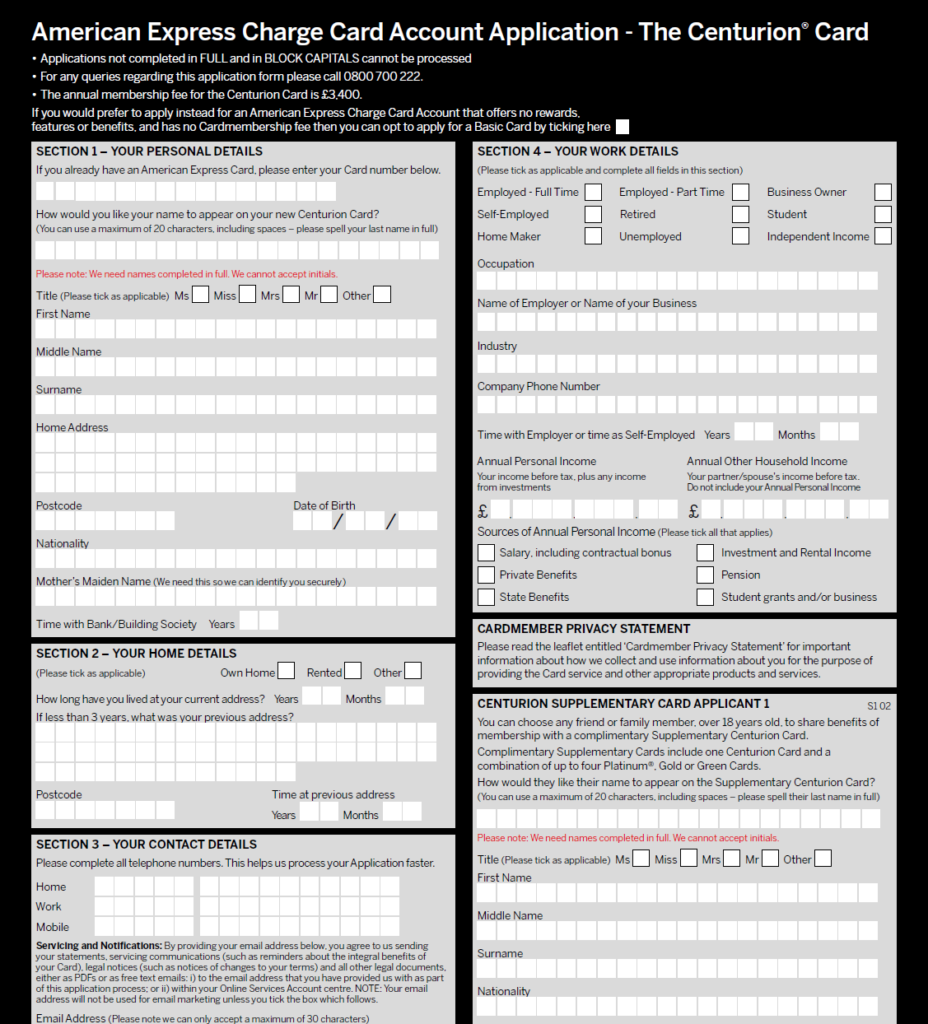

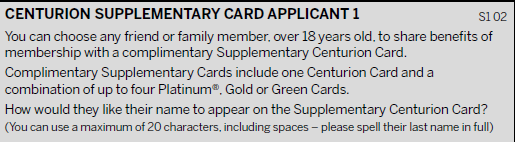

Since my friend is based in the UK, it’s sensible to apply for a UK Centurion card too. After receiving the invitation, he still needs to fill out a form.

[Fees]

Because he’s already a Centurion cardholder, the joining fee is waived. Last I heard the fee was £3,000, although I’m not sure if it has increased since.

The annual fee is £3,400.

Unlike the US counterpart, the UK Centurion card comes with a free supplementary card.

[Welcome Box]

It took five days for the application to go through, and then two more days for the cards to arrive.

[Card Designs]

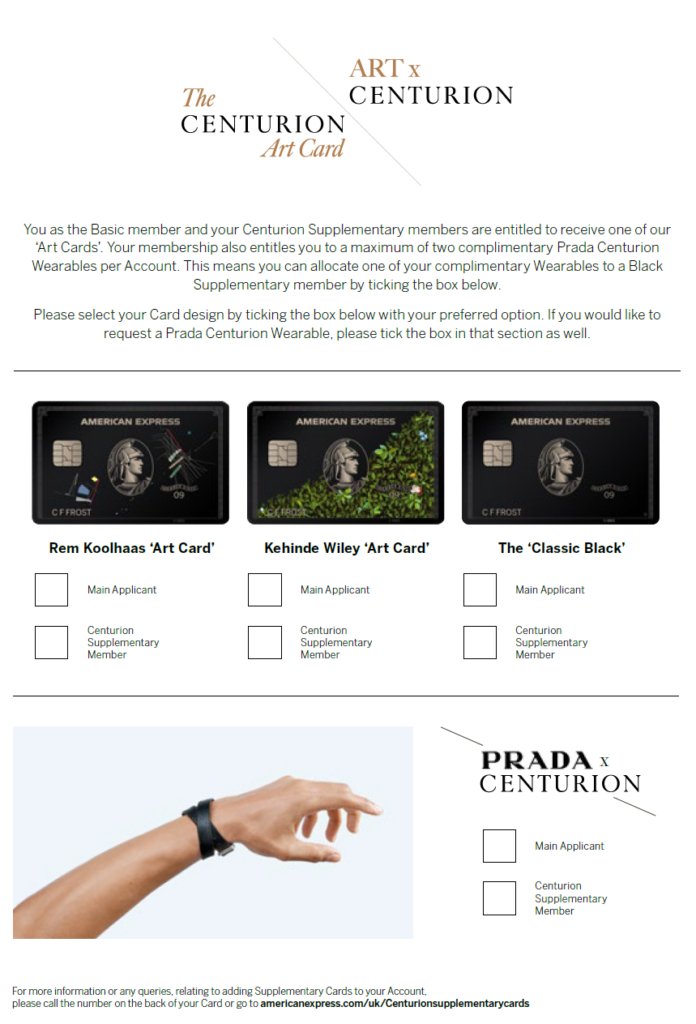

Similar to the US Platinum card, the Centurion card offers two artist designs besides the classic design, by Kehinde Wiley and Julie Mehretu respectively.

The two UK cards and one US card completes the collection 🙂

[Status Benefits]

The Centurion card offers elite status with the following airlines:

- Virgin Atlantic Flying Club – Gold

- Emirates Skywards – Gold

The following hotels:

- Hilton Honors – Diamond

- Marriott Bonvoy – Gold

- IHG One Rewards – Platinum

- Melia Rewards – Platinum

- Radisson Rewards – Gold

- Jumeirah One – Gold

And two car rental companies:

- Hertz – President’s Circle

- Avis – President’s Club

It may strike you first as an extensive array, but once you dig into the details you will feel much less excited. Hilton Diamond has substantial benefits but it’s not difficult to get; Melia Platinum and Jumeirah Gold have good perks, but their footprint is limited. Marriott Gold and IHG Platinum are next to useless…

In terms of airlines, the two offers are good, however neither VS or EK belong to any major alliance so the memberships don’t get you very far. In contrast, US Centurion card offers Delta Diamond status which is accepted across the entire Skyteam, and my friend also availed Star Alliance Gold and Oneworld Sapphire via status match programs.

[Lounge Benefits]

Lounge access benefits are almost identical to the Platinum card:

- Priority Pass (+1 guest only)

- Amex Centurion Lounge

- Eurostar Lounge

- Plaza Premium / Lufthansa / Delta / Escape Lounges etc.

The Centurion card only makes a difference when you access the Centurion Lounge or the Lufthansa Lounge. You can read more about the Amex Lounge benefits here.

The US Centurion Card issued Priority Pass can bring in unlimited number of guests.

[Other Benefits]

Fine Hotels & Resorts: stay a minimum two nights and enjoy an additional $200 credit on FHR bookings at select luxury hotels.

Limousine Transfers: eight complimentary two-way airport transfers, but the snag is you must book the flight with Centurion services.

Airport Fast Track: available at Heathrow, Stansted, Manchester and East Midlands.

Lifestyle Credits:

- Harvey Nichols: £500 annually

- Clos19: £500 annually

- Addison Lee: £20 monthly

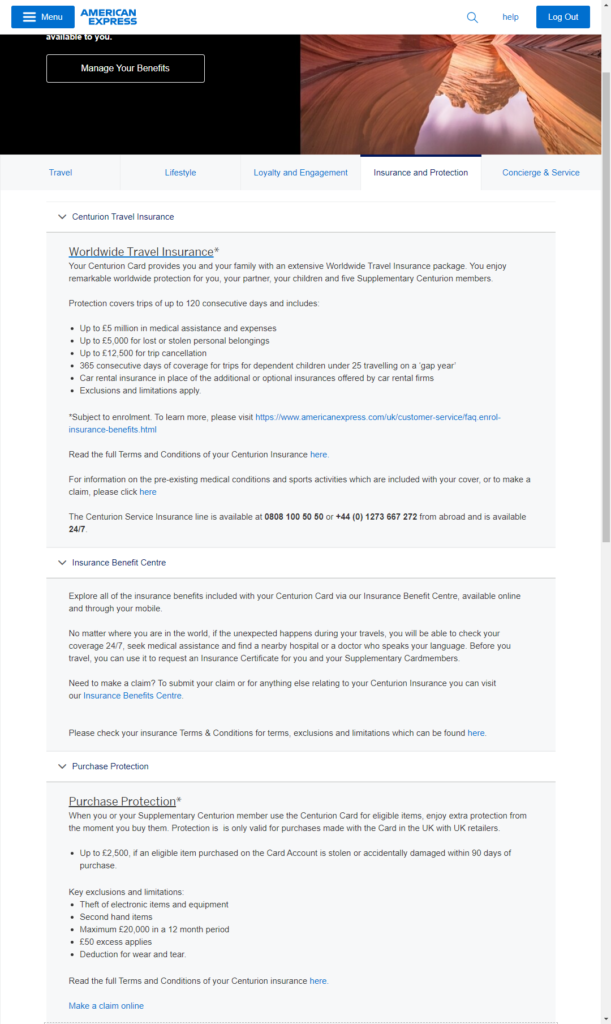

[Travel Insurance]

From what I’ve heard it’s way better than the US card.

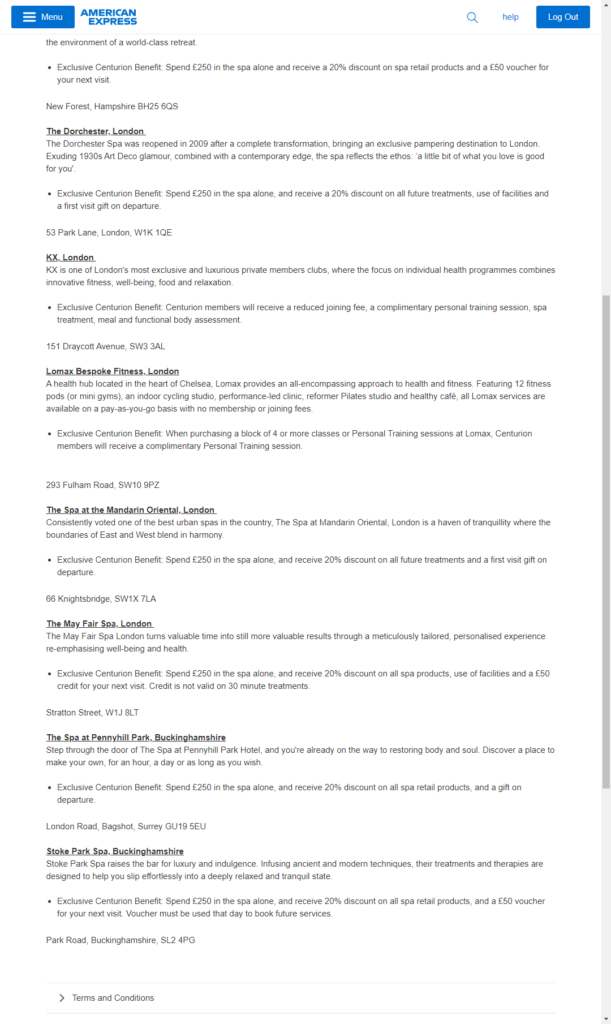

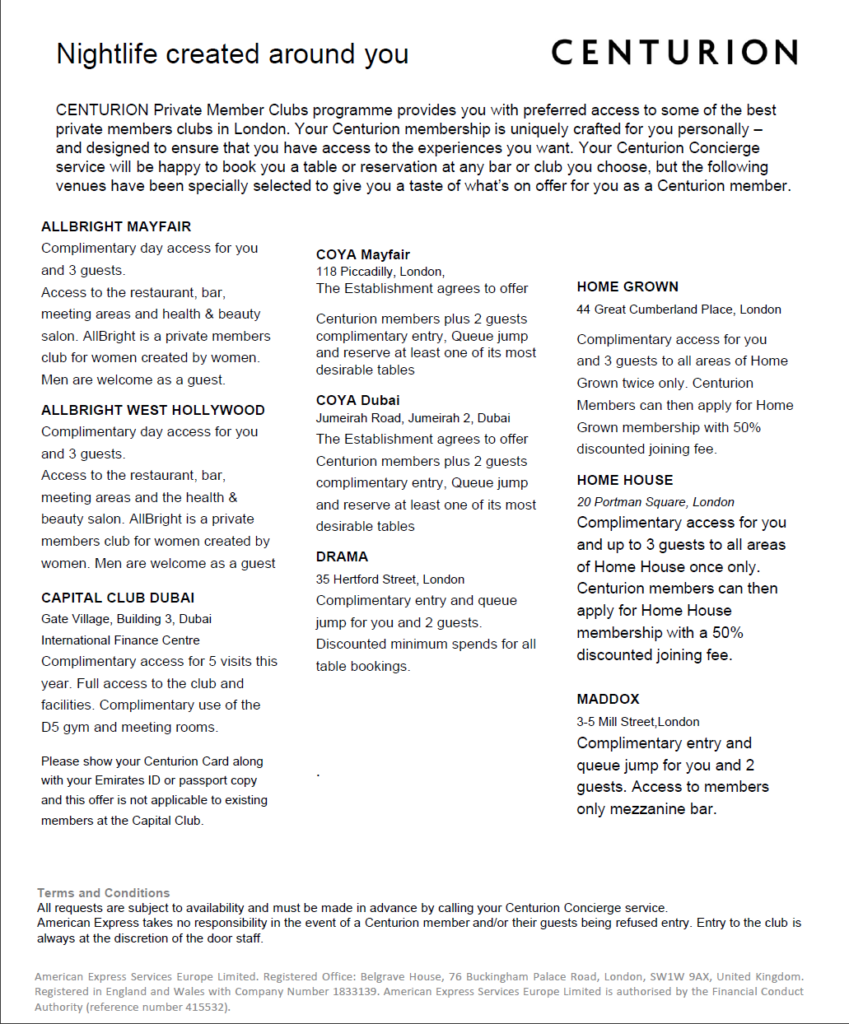

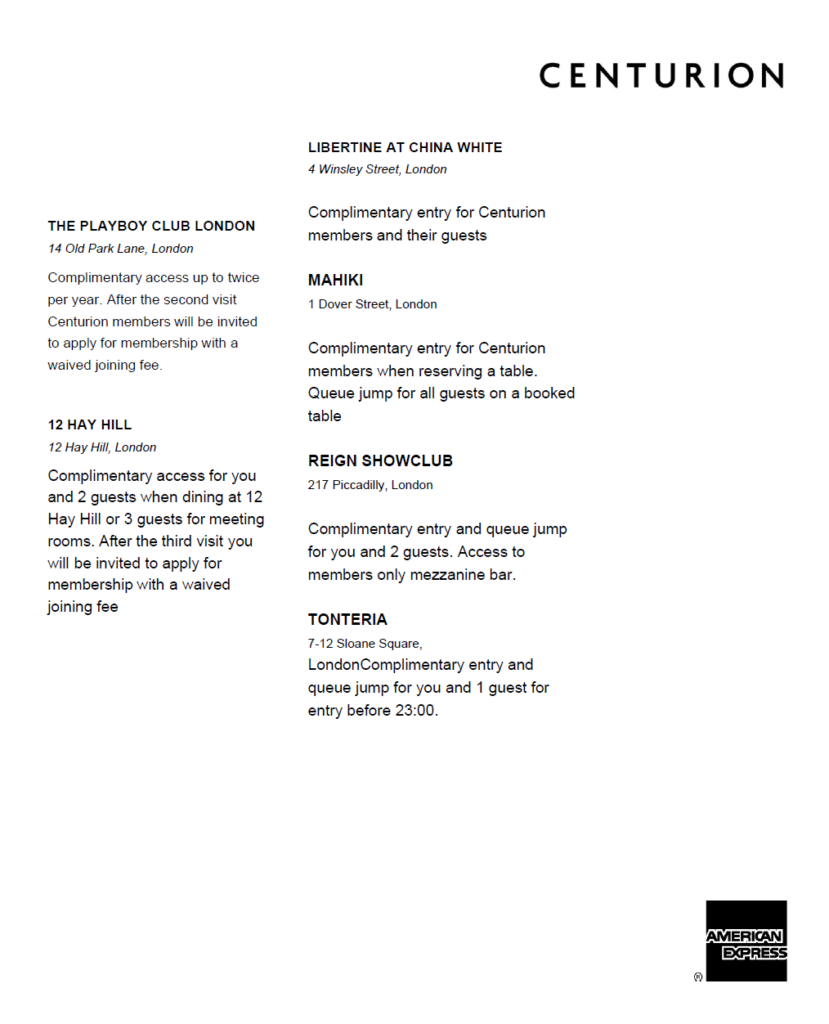

[Spa, Fitness and Clubs]

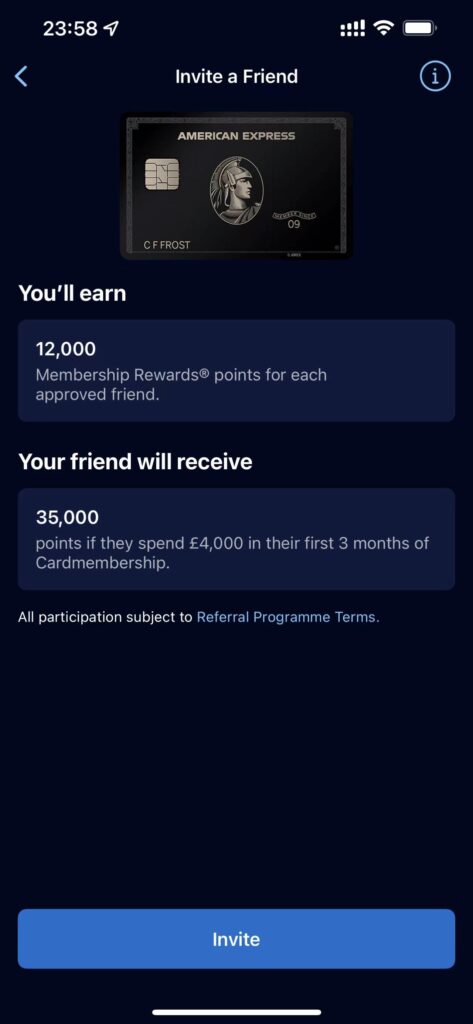

[Refer A Friend]

Something that you surely didn’t know – The Centurion card also has an invite-a-friend feature:

However, the referral link opens an application for the Platinum card…

Okay that’s it! I’ll probably never qualify for this card, but to be honest the benefits are underwhelming and I wouldn’t pay £3,400 anyway. What do you think?

My review of Virgin Atlantic Upper Wing & Clubhouse at London Heathrow T3

I have been to most of the lounges at Heathrow. Amongst the remaining ones (that are still open) Virgin Atlantic’s Clubhouse definitely tops my list. I didn’t fly with them that much, and never from Heathrow with a qualifying ticket so had no chance of trying the Clubhouse out.

This June I bought a ticket in Premium to the States, and used my credit card voucher to upgrade to Upper Class. In fact I status matched to Virgin Gold last December so should gain access to the lounge anyway.

In short, the following passengers can access the LHR T3 Clubhouse:

- Virgin Atlantic Upper Class / Delta One passengers

- Virgin Atlantic Gold / Virgin Australia Gold or above, when flying with Virgin Atlantic

- Delta Platinum and Diamond / Flying Blue Platinum, when flying with Virgin Atlantic or Delta

What I find really confusing is, Delta and Flying Blue elite members can use the lounge when flying with Delta, but Virgin Atlantic Gold members can’t. It must be a mix-up?

The entry rules were once very generous to VS Gold, as they could use the Clubhouse no matter which airline they were flying with (even BA). Sadly due to the overcrowding issue introduced by Delta passengers, it’s no longer the case.

Similar to BA’s First Wing at T5, Virgin Atlantic has an Upper Wing at T3 as well. If I interpret it correctly, only Upper Class and Delta One passengers are welcomed here so elite members aren’t allowed. It even has a dedicated driveway, and they verify your name at the entrance.

Don’t quote me on this, but I think it’s outside the Heathrow £5 drop-off charge zone.

The inside is much smaller than First Wing though, with only a couple of desks.

Thanks to its exclusiveness the check-in is really fast. When ready you can proceed to the security checkpoint.

Unfortunately Upper Wing doesn’t have its own security check facility, and it’s simply a reserved corner of the T3 screening facilities. After it’s done, you’ll merge with the general public and find your way to the Clubhouse.

The experience is a bit underwhelmed and not comparable to BA’s First Wing, as the latter has their own security checkpoint and you arrive into Galleries First within seconds. If you are travelling peak times (for example half-term) it might save you significant time, but otherwise I’m not sure if it’s necessary.

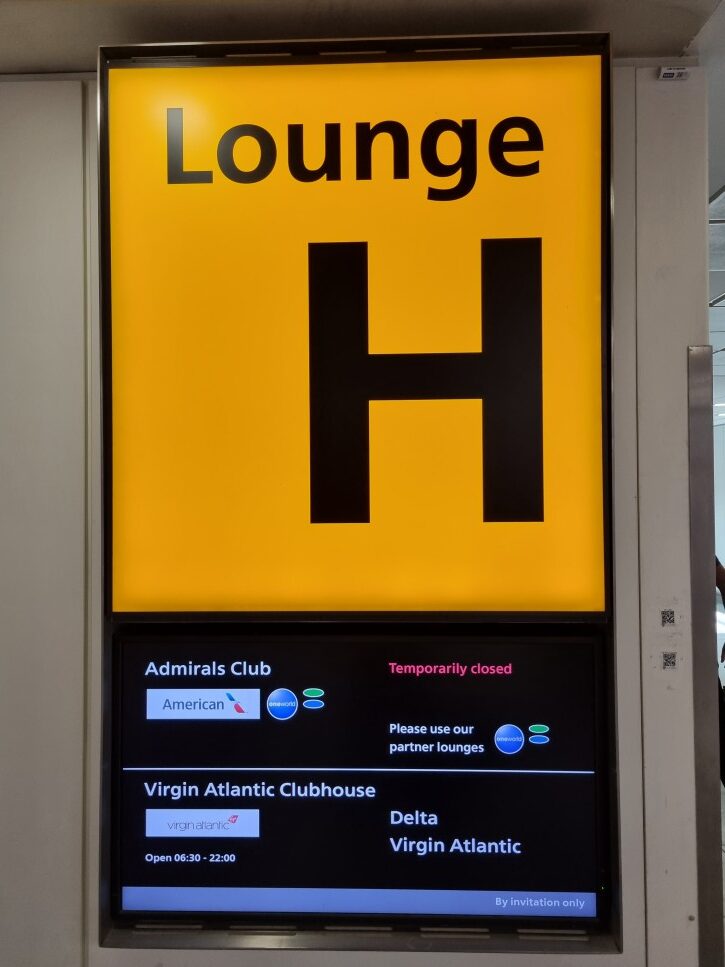

The Clubhouse is nicknamed Lounge H. When you enter the area of airline lounges, Qantas and Cathay Pacific are on the left, whereas BA, AA and the Clubhouse are on your right.

It’s above American’s Admirals Club.

Today happens to be the Platinum Jubilee and they’ve added some special celebratory decorations.

I was a bit shocked by how busy the lounge is…

You should notice the very long bar right away, which is deemed as the best at Heathrow.

There are many different kinds of seats in the lounge.

Going past the dining area (I forgot to take photos there) and you’ll reach the quieter business zone.

You can watch TV here.

Behind the bar there are some window seats shielded by a glass wall. They are probably the best spot in this lounge for good privacy and runway view.

The lounge is very purple-y, just like Virgin’s planes. There is also a mini-gym with three Peloton bikes, although I don’t think it’s a good idea to exhaust yourself before boarding a flight.

This is the other side of the lounge, with a couple of hanging pods.

A very Instagram-able spot:

This is the very quiet relaxation area.

On the first floor there’s a small entertainment room with a pool table.

Further up there’s a nice terrace if you want to enjoy the sun.

Bathroom:

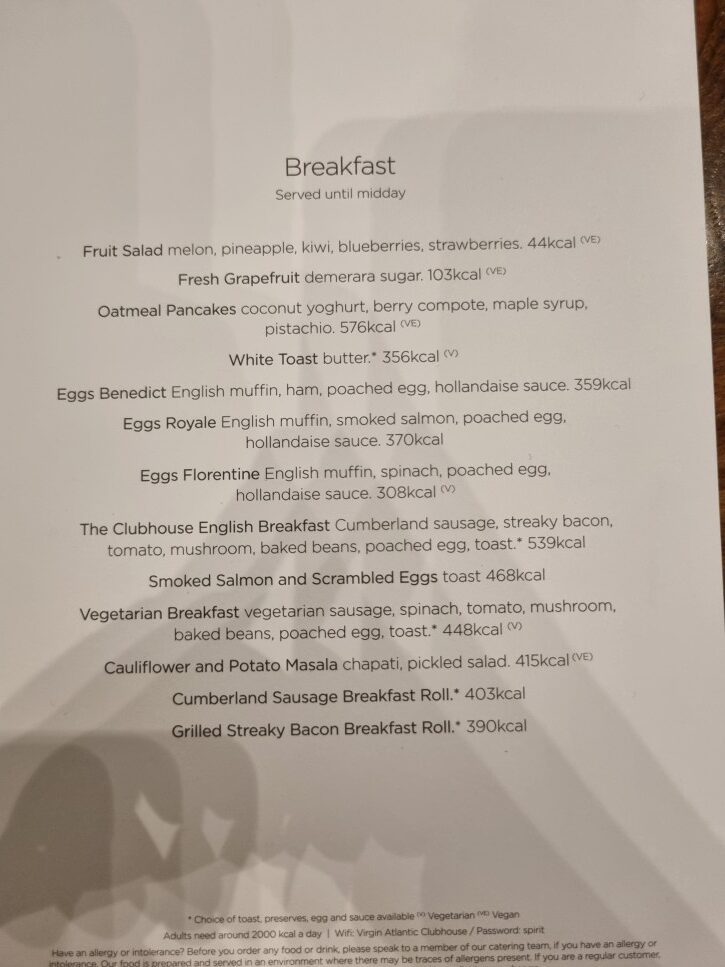

Dining is mainly table service. You can either order from the waiter or scan the QR code.

I had a big breakfast here.

There’s also a deli counter where you can grab some stuff yourself.

What do I think? Well, don’t get me wrong – Virgin Atlantic’s Clubhouse at Heathrow T3 is still a pretty decent lounge, but it’s not at the same level as it was years ago. Before its partnership with Delta and Flying Blue the Clubhouse was a quiet paradise reserved for its own passengers and members only, and now it simply doesn’t feel exclusive at all anymore. In fact I find it even busier than BA’s Galleries First Lounge.

Virgin’s cost cutting measures in the past years are also to blame. The Clubhouse used to offer a hot tub, free haircut and massage services, yet now there’s nothing left besides food. Unfortunately it can no longer differentiate itself from the other lounges at Heathrow. In fact I probably prefer the Amex Centurion Lounge or Cathay Pacific Business Lounge unless I really crave an a-la-carte menu.