Home » Regions (Page 20)

Category Archives: Regions

My review of Cliveden House, A Mr & Mrs Smith Hotel

Its partnership with Mr and Mrs Smith adds a lot of excellent hotels to IHG’s portfolio. IHG members enjoy Smith Extras when staying with them, which usually means a bottle of Champagne, a box of chocolate or sometimes free breakfast. Ambassador members are also entitled to GoldSmith benefits, which includes space-available room upgrade and potentially enhanced Smith Extras.

You can redeem IHG points on reward stays at Mr & Mrs Smith hotels too, at a rate of $6.2 per 1K points roughly. Even better, the free night voucher issued by the UK Creation credit card is valid on them as well, although I’m not sure if it’s a bug.

One of the best redemptions in Europe is probably The Retreat at Blue Lagoon in Iceland.

There are many outstanding choices in the UK too, and my decision went with the Cliveden House in the end simply because it’s closest to London. There are a few properties in the same league, such as Lucknam Park, Chewton Glen and Heckfield Place.

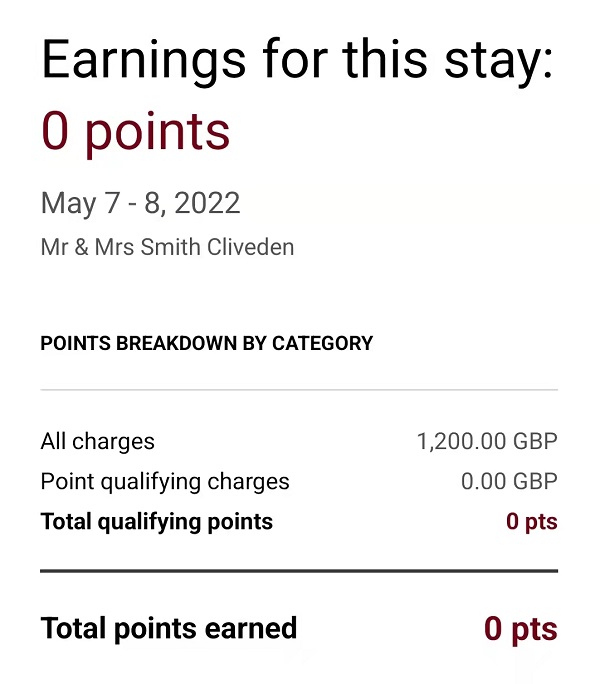

IHG paid £1,200 for the night.

Cliveden House is at the centre of the Cliveden National Trust, which is about one hour’s drive from central London. Hotel guests need to pay £18 per person as a result, unless you have a valid National Trust membership.

The only other similar property that I’ve ever stayed at is the Langley, a Luxury Collection hotel. In terms of the neighbourhood Cliveden House wins hands down. Langley is only a local park which isn’t well taken care of, whereas Cliveden is a very well maintained National Trust site and probably one of the nicest parks you can find near London.

A beautiful boulevard leads you to the house.

There are a huge lawn and mazes at the back of the house. You can follow the steps down to River Thames.

Cliveden House was built in the 17th century by Duke of Buckingham as a hunting lodge for his mistress and guests. It was bought by William Waldorf Astor in the 19th century, and you can still see the name Astor in many places.

Meghan Markle stayed here in 2018 the night before the Royal Wedding.

The house was last renovated in 2015. It doesn’t look as new as The Langley, but ages well.

IHG’s IT system is a mystery, and I don’t know how they decide what room type you can redeem vouchers for. I was able to use mine on Deluxe Room with Hot Tub, which is only one level below the suites and almost doubles the cost of a standard room.

The room is located at the same wing as the spa centre.

Cliveden House has no room numbers, and instead rooms are named after titles. I’m Load Lothian obviously, which doesn’t sound bad at all 😉

There’s a wardrobe once I enter the room, with the bathroom to the right and bedroom to the left.

The room is nothing much to write about, except for the bed which is quite comfy. There’s a nice tub in the bathroom, but trust me you won’t need it!

Best feature of this room is a small terrace:

Plus a private hot tub:

The terrace is connected right to the swimming pool. I don’t even need to check in at the spa centre!

The facilities are great. The swimming pool is quite deep though (1.83m) and too scary for an amateur like me.

According to my observations, there are a total of four rooms with a terrace, and mine is the only one that has direct access to the swimming pool. Privacy may be one concern though.

My friend who visited the following week told me there’s actually an indoor swimming pool, and took a photo for me.

Smith Extras are a small bottle of Laurent Perrier and some chocolate / snacks. No room upgrade is offered, but to be honest I don’t really want to sacrifice my terrace for a suite 😛

For breakfast there are two options:

- Continental only: £20

- Continental + hot breakfast: £25

They’ve put some good thoughts in furnishing the restaurant, however the continental selection is very limited.

I ordered eggs benedict and porridge for my breakfast. Honestly they are mediocre at best, although £25 is a fair price for an expensive hotel like Cliveden House.

Besides the main restaurant, you can also dine at the Aston Grill or the bar.

Cliveden’s visitor centre is a short walk away, where you can get some simple food and refreshment.

Check-out time is 11am, and you can probably request a one-hour extension but no further. You are still invited to use the pool after check-out which is a nice gesture.

There’s a problem with my door, and they can only unlock the room with a special device which causes a lot of inconvenience to me. The staff are very apologetic though. Not sure if it’s related, but they didn’t charge me for the breakfast in the end.

It is truthfully a very unique experience for me and no doubt Cliveden House is the best hotel I’ve stayed at so far in the United Kingdom – although according to the staff they usually refer to is as a House rather than Hotel. I’m not sure if it’s worth paying cash here via IHG (as prices may be lower elsewhere), but if you have sufficient points or some free night vouchers to burn, I highly recommend staying here for a couple of nights.

How to redeem your Virgin Atlantic Credit Card Upgrade voucher

Virgin Atlantic Reward+ Credit Card is probably the best non-Amex traveller card in the UK, and the Tier Reward after hitting £10,000 annual spend is quite attractive. One of the rewards to choose from is an upgrade voucher, and I’ll talk about how to use it today.

[Receiving the Voucher]

First of all, you should receive the voucher within 30 days of spending the qualifying amount. You won’t receive an email or see it in your Virgin Atlantic account, but you’ll see the following row in the activity statement:

You don’t need to specifically choose from the three Tier Rewards, instead whenever you are ready you can just redeem straightaway.

[Facts]

The voucher can be used on both revenue and reward tickets. This is a big advantage over the BA upgrade voucher issued by Barclaycard.

Only Virgin Atlantic operated flights are upgradable. Economy Light tickets are non-upgradable.

The voucher can be used to upgrade a return flight or two one-way flights. You can use half of the voucher on a one-way flight and save the other half for the future.

You can upgrade one-cabin, i.e. Economy to Premium or Premium to Upper Class.

Reward availability is required in the upgraded cabin.

You need to pay the difference in taxes and charges.

The voucher cannot be redeemed online. You must call the contact centre to redeem it.

It can be applied on tickets issued by travel agencies too – you don’t have to book directly from Virgin Atlantic, which is good as they don’t have best rate guarantee.

You can redeem the voucher for someone else – you don’t have to travel.

[Calculating the charges]

To know how much you need to pay for the upgrade is easy. Say that you want to upgrade a one-way flight from London to Miami, then just search any date for that route on Virgin’s website. Select a flight and cabin then you’ll see ticket price on the next page:

See Taxes, fees and charges? It’s not the whole picture though, you must click the link to view the actual breakdown, which will show you the carrier-imposed surcharge too:

The two numbers combined are payable charges for a reward ticket. And in this case:

- Economy: £120 + £169 = £289

- Premium: £120 + £270 = £390

- Upper Class: £350 + 270 = £620

Which means you must pay £101 for upgrading from Economy to Premium, or £230 from Premium to Upper Class.

[Using the Voucher]

The first thing you need to ensure is reward availability in the cabin you want to upgrade to. Since Virgin Atlantic doesn’t guarantee reward seats on any flight, you may need to search their website often or subscribe to one of the alerting services.

Once you find it:

- For reward ticket, you don’t need an existing booking, simply call in to make the booking with points and voucher

- For revenue ticket, you don’t need any Virgin points, just call in to upgrade with the voucher

Since fuel surcharges are sky high at the moment, upgrading a revenue ticket usually turns out a much better deal.

Virgin Atlantic actually has a Gold service line which isn’t publicised on their website. However if you are a Gold member you should be able to find the 0800 number in any newsletter they sent you. I wasn’t aware and just called the regular number at 7pm on Wednesday. It took 25 minutes to get through, which wasn’t too bad.

The agent could see reward availability and my upgrade voucher no problem. She asked for my credit card details to pay the £230 charge, which is identical to my calculations above.

It’d be nice to be able to redeem the voucher online, but overall the contact centre experience was smooth and positive, and I think paying £230 for an upgrade to Upper Class, plus finally finding a use for that voucher feels really good!

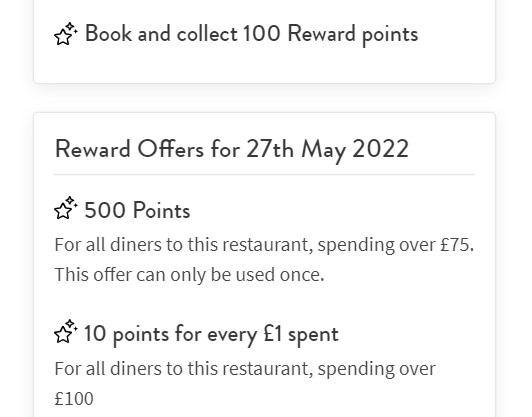

Earn voucher or Virgin points on restaurant dining via SquareMeal

We wrote about IHG’s partnership with OpenTable which allows you to earn IHG points when making restaurant reservations. It turns out that OpenTable isn’t the oligarch in the industry and SquareMeal provides a very similar service.

SquareMeal has a wide range of business operations, but we’ll just focus on the dining part today. Basically:

- You earn 100 points for each restaurant reservation

- You also earn points when dining at select restaurants and paying with linked cards

For the second perk, you can search on their website and filter by Restaurants With Reward Offers:

You need to link a debit card or credit card (Visa / Mastercard / Amex) to your SquareMeal account. If you put enough spend through the designated card at participating restaurants you’ll earn a bonus. You don’t have to reserve via SquareMeal in this case, but there aren’t many participating venues.

You can opt to earn one of the two kinds of points:

- SquareMeal Points: 100 points = £1, and the voucher can be redeemed at participating restaurants

- Virgin Points

The first option sounds better value to me, providing that the vouchers are easy to exchange and redeem. Don’t forget to weight in the 150 IHG points from OpenTable in your equation.

The following are some ways to earn points:

- Sign up with my referral link and reserve once to earn 300 points

- Add your first debit / credit card to earn 100 points

- Earn 100 points every time you reserve a restaurant

- Earn 25 points every time you write a review

Of course, you must show up to your reservation to earn the points.

My review of Aloft Birmingham Eastside

Marriott’s Every Night Counts promotion is coming to an end, and I’m participating one last time at the Aloft Birmingham Eastside hotel while visiting a friend in Solihull.

If you are looking for a central hotel IHG is your best bet. Somehow none of the Marriott hotels is ideally located. The Aloft is right next to the Aston University, and about 20 minutes’ walk into Birmingham’s New Street station.

From my limited experience, Aloft and Moxy share similar design concept of their public areas, although Moxy has more of a sexy element when it comes to guest rooms.

The hotel has a big ground floor, with a colourful bar by the entrance.

It’s not really a busy day but I didn’t receive any room upgrade. When asked about upgrade availability the receptionist told me “your room was pre-allocated this morning”, which isn’t really an answer. I didn’t bother to pursue as I just needed a bed for one night.

The room is about what you’d expect from a budget brand, basic but clean. It’s weird that Aloft usually positions itself in the four-star league, whereas in terms of quality and price it’s more on a par with Holiday Inn, Hampton or Ibis.

As a Titanium member I could choose breakfast as the welcome amenity. Breakfast is served in the Tempo restaurant, next to which is a Refuel station where you can purchase snacks.

Standard buffet:

Gym room:

Overall the hotel is okay, however unless you need to be in the area or the hotel’s rate is very good, I think there are plenty of better choices in the city.

£10 Amazon credit for Barclaycard customers

If you are a Barclaycard customer, there’s now a chance to grab a free £10 Amazon credit.

You can check out the offer details here. Note that according to the terms and conditions you must land on the offer page first before taking part.

- Offer ends September 30

- Pay at least £10 on Amazon with your Barclaycard

- You’ll then receive a £10 voucher to use by October 30

The offer should be open to all Barclaycard customers – note that it is Barclays’ credit card division, so debit cards that come with their current account won’t qualify.

My review of Eurostar Business Premier Lounge, Paris

Eurostar departs from the Gare du Nord station in Paris, with a dedicated entrance on the second floor. After entering, you’ll pass the border control of France and UK, the security check and then you’ll be in.

On your left, you can take the stairs or lift up to find the Business Premier lounge, which is available to Business Premier / Carte Blanche guests, or Amex Platinum cardholders.

Unlike the London lounge, the Paris one occupies only one floor, but it pans out nicely. Once inside you see the main lounge area on your right.

Which is connected to the drink and snack area.

The selection of snacks is noticeably better than London. There is also a bar, which isn’t serviced at the moment.

The left part of the lounge is comprised of semi-private compartments, ideal as a workspace.

Some of the seats come with a view of the station.

Similar to its London counterpart, this lounge is a good place to chill and refuel a bit before your journey, but not really worth spending a lot of time in.

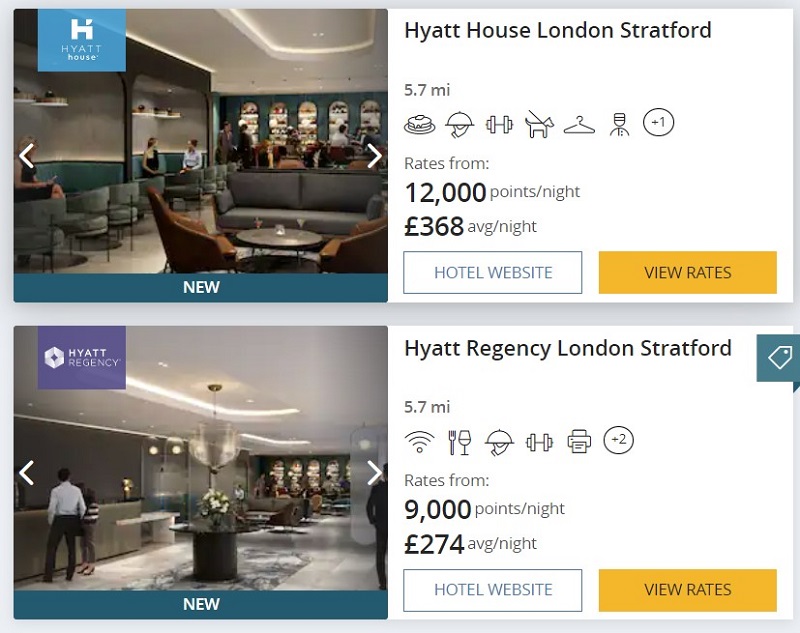

Hyatt: new London hotels, Asia Pacific bonus points offer

Hyatt has recently opened two new hotels in London:

They were recently converted from Holiday Inn and Staybridge Suites of the IHG brands. From what I see their room rates have almost doubled to an eye-watering level (sometimes £300+), which is insane for the location. I hope they’ve done a great renovation job!

On the other hand, if you do want to stay with them spending points appears to be a great option. I find Hyatt’s new redemption pricing confusing, but for an upcoming Saturday they only cost 9,000 points and 12,000 points respectively.

You also earn 500 bonus points per night when staying at either of them by July 31.

Also Hyatt-related, they have started a new Mid Year promotion in Asia Pacific.

- Register by July 31

- Stay between May 16 and September 2

- Earn 1,000 bonus points for every two nights stayed

- Maximum bonus awarded is 15,000 points

You can see the list of participating hotels on the promo page, which seems to cover most properties except those in mainland China.

Apply for a U.S. card without SSN/ITIN via Amex Credit Passport

U.S. no doubt has the best credit card offers in the world, and many people from overseas are very keen on applying for one. It’s tricky though, as unlike in the UK you usually need to provide a tax number (SSN or ITIN) when submitting an application, and you may not have one if you still live abroad or have recently moved.

There’s a well-known workaround though – if you are an Amex cardholder overseas, you could apply for a U.S. Amex card via its Global Transfer service. You don’t need an SSN / ITIN or any credit history in the U.S. – all you need is a U.S. residential address and a phone number, and Amex will use your internal credit record with them to evaluate the application.

It’s usually a very smooth process, and everyone I know who’ve tried succeeded, although some of them were asked for some sort of bank verification.

It’s not until recently that I became aware of another service that Amex U.S. offers – Credit Passport, provided by Nova Credit.

The idea is quite similar to Global Transfer, which aims to facilitate the application for people who don’t have a tax number yet in the country. However,

- You don’t need to be an existing Amex customer

- Your credit history in the current residential country will be used for the application

Currently nine countries are supported: United Kingdom, Canada, Australia, Mexico, Brazil, India, Kenya, Nigeria and Dominican Republic.

Note that the application only triggers a soft pull in the United Kingdom as well as in Canada, Australia, India and Dominican Republic, which means it doesn’t negatively impact your credit score.

To be honest I don’t think it’s a very useful feature, as all listed countries issue their own Amex cards, with the exception of Dominican Republic. My speculation is that having an Amex card and doing the Global Transfer would have a much higher success rate.

However, if somehow you don’t have an Amex card, or the Global Transfer doesn’t work out, you may want to try Credit Passport to apply for your first U.S. credit card. A reader from Canada has just reported success so it’s a viable route.